I have had a mixed portfolio at Fidelity for 10 years now, this past Friday I sold off my entire portfolio and am investing is a new "model". I was thinking 25% bonds at least for the short term, (I am really not a fan of bonds)..... I am not very savy about all this, so I really just look at the tools on Fidelity's website, then pick according models..... I do a bit of research on each fund then go for it and let it sit for a few years.... I have left $$$ on the table.... Fidelity keeps offering their Managed Serives for .85% fees, but I really do not think I am ready to do this...... Curious from those that understand the bond market.... Do you think it is a good time to buy bond funds, are there some particular funds listed on the Fidelity site to researh? ..... I am thinking if you say yes it is a good time, possibly invest for 12 to 18 months and see how they perform

Do you think these funds would generate over 6%..... I have been doing 6 to 1 year CDs for the past year. I am thinking I could make better choices with 2 - 4 Bond Funds ..... What are your thoughts

I don't really understand what you held, or what your goals are. I used to pick whatever was hot only to have it turn cold; now I realize that models and predictions are no more accurate than throwing a dart. If there are people that can actually outguess everyone else about the future, they trade solely for their own account from their private island. Or as Jack Bogle (late Vanguard CEO) said, "I've never met anyone that could time the markets consistently, in fact, I've never met anyone that met anyone that could do it".

Maybe try going to the bogleheads.org wiki and reading about getting started. It will walk you through making a plan (that they call an investor policy statement), deciding on a stock/bond asset allocation and then buying a total stock market fund to meet your stock allocation. Note that long term, your enemy is inflation, not stock volatility, so unless you have way more than you'll ever spend, you should have some stock exposure, retirement studies suggested a minimum of 30% stocks for a 30 year retirement. Like you, I've always hated bonds and 2022 did nothing to help that. I've stuck with my 80/20, but you have to pick a number that lets you sleep at night.

If you want some international flavor, you can put 20-30% of your stocks in that as insurance against bad governance in the US or the US market getting way overvalued. When year after year of bad international performance drags on, you have to remind yourself that this is insurance.

Fixed income deserves more discussion.

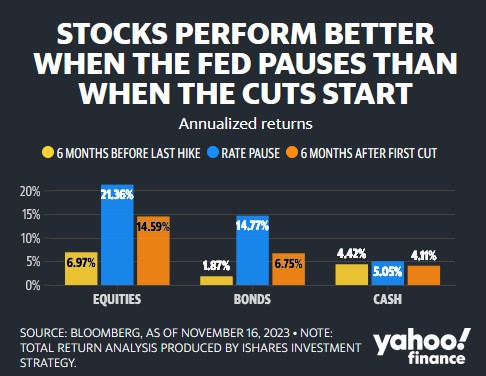

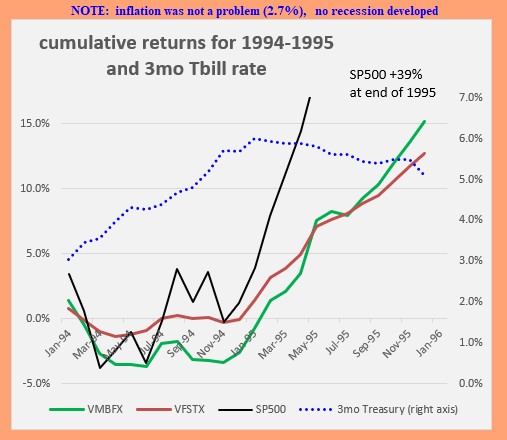

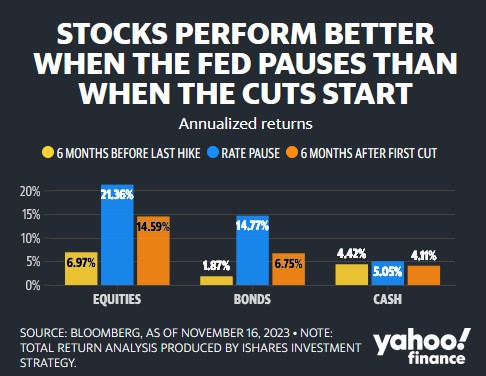

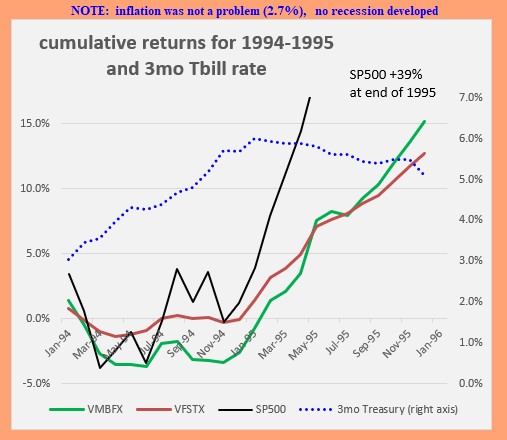

-For money you will need soon, money markets or CDs are OK, though if bond interest rates drop, you will not participate in the gain.

-Some folks buy a ladder of TIPS - if they know their cash needs, that protects them against inflation. If they're wrong about their cash needs, the inflation protection is not as good.

Bond funds are just a collection of individual bonds managed by the broker. That's good in that the broker is a pro in evaluating the risks and they get very good pricing when they buy and sell. It's not so good in that duration of the fund is roughly constant, but your remaining lifetime is not and you may have specific needs for them money in shorter time frames than that. Funds that have longer duration than your average need for the money are a poor fit. That can be mitigated by selling some off each year so the average duration matches your duration.

Some folks want to hold individual bonds, but if you do so, I suggest limiting your holdings to Treasuries or TIPS, you do not want to lose out because you incorrectly assessed the call risk or default risk of some corporate bond.

I try to keep things simple and just use an intermediate bond fund like Vanguard's BIV or BND and we keep 6 months or so of spending needs between checking and a money market account.