I think them Bull horns are going to gut the Bear.I have to admit that I've never been more bullish than now.

Stocks are very cheap.

The job market is starting to get a little traction.

Housing will eventually recover, say in 2015 or so.

Oil may go up, but we've got plentiful supplies of dirt cheap natural gas to power our industries.

The big multinationals will make money hand over fist in the years to come.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bullish?

- Thread starter JCW.82

- Start date

veremchuka

Thinks s/he gets paid by the post

No and yes. No immediately, we have gone too far too fast, a pull back is imminent. over the year yes.

I have made 6 purchases in my 401k since late July of the S&P 500 index. This is a market timing endeavor, no two ways about it. 1 purchase was not good, 2 were so so, 1 was pretty good and 2 were very good, nav wise that is. I wanted to get out on 1/23 but held off and was convinced I blew it but it's been a slow melt up. Yesterday I was going to exchange out back to Stable Value but thought the Greece situation may provide more fuel. As 4 pm approached, markets were almost flat for the day and I should have known better.... Anyway today I took my profit, 11.2% for 7 months, not bad.

Now for the hard part, when to get back in! Again this is market timing, I'm doing this strictly when I see prices too good to pass up. But now it's hard to figure just how far a pull back may go. I hope to catch 1 more run up before late April/early May. We'll see how that goes.

I have made 6 purchases in my 401k since late July of the S&P 500 index. This is a market timing endeavor, no two ways about it. 1 purchase was not good, 2 were so so, 1 was pretty good and 2 were very good, nav wise that is. I wanted to get out on 1/23 but held off and was convinced I blew it but it's been a slow melt up. Yesterday I was going to exchange out back to Stable Value but thought the Greece situation may provide more fuel. As 4 pm approached, markets were almost flat for the day and I should have known better.... Anyway today I took my profit, 11.2% for 7 months, not bad.

Now for the hard part, when to get back in! Again this is market timing, I'm doing this strictly when I see prices too good to pass up. But now it's hard to figure just how far a pull back may go. I hope to catch 1 more run up before late April/early May. We'll see how that goes.

Considering the context of Roubini's usual doomsday rhetoric, for him that is bullish...Well, Roubini isn't exactly bullish!

What he said was that stocks would continue to go up the first half of the year, then go down the 2nd half to be about flat. Nope, not bullish at all.

Orchidflower

Thinks s/he gets paid by the post

- Joined

- Mar 10, 2007

- Messages

- 3,323

Bought a good chunk of stock just about the time things started turning, but now it's all too expensive and I've done alot of homework. I'm staying status quo for now myself.

However, I can say that I've never prayed the market would fall so much as now. I have a nice "buy" sheet ready but things are now just too high.

Waiting for the second half of 2012 when supposedly it goes flat...so not a very strong "moo" from this weak bull.

However, I can say that I've never prayed the market would fall so much as now. I have a nice "buy" sheet ready but things are now just too high.

Waiting for the second half of 2012 when supposedly it goes flat...so not a very strong "moo" from this weak bull.

grizzlyff

Dryer sheet wannabe

was bullish, just went temporarily to 95% cash

How do you plan to invest that cash? Do you have specific assets and price levels in mind or are you just staying safe?was bullish, just went temporarily to 95% cash

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Its a success for me, but it always gives me the heebie geebies for a while when sentiment changes and the market suddenly starts chasing one of the names I bought when it was hated. It is especially hard to get when it happens quickly. I don't see much that is different with LOW now vs 6 or 24 months ago, but clearly the market does.

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

Considering the context of Roubini's usual doomsday rhetoric, for him that is bullish...

+1

I'm conflicted on equity valuations (profit margins are off the charts) and bond valuations are horrifying. Yet my sense is that the economy has achieved escape velocity. Things are still fragile, war with Iran, an unraveling in Europe, or the massive tax increases and spending cuts in current U.S. law can certainly derail things, but absent a new meaningful shock this bull's got legs. It also seems to me that the Fed will not make the same mistake it made in mid-2009 by talking up an exit strategy before there are clear signs of a need for one.

Last edited:

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Cautiously optimistic, but not bullish. When we have to pay the piper and take steps to revalue our currency upwards to keep foreign govts to buy our debt, it's not going to be pretty for the equity markets.

ducky911

Recycles dryer sheets

- Joined

- May 18, 2010

- Messages

- 497

Bullish?

Short term:No

Mid term:Yes

Long term:Hope so?..?

Short term:No

Mid term:Yes

Long term:Hope so?..?

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Hmmm, I am beginning to think that a lot of people have become reflexively pessimistic over the last several years. I see lots of things moving in the right direction: profits, labor market, funding conditions, etc. With hthe Greece exchange in the rearview mirror, perhaps some of these positive developments will occupy more of the media's attention.

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Hmmm, I am beginning to think that a lot of people have become reflexively pessimistic over the last several years. I see lots of things moving in the right direction: profits, labor market, funding conditions, etc. With hthe Greece exchange in the rearview mirror, perhaps some of these positive developments will occupy more of the media's attention.

I don't know about all that........

Yes, profits are up, but companies are sitting on a TON of cash because of restrictive regulatory environment......

Labor market is better than the depths on 2009 but have a LONG ways to go.

Greece is not "over"........it is merely hibernating........wait until he hit austerity in the US...........

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

I don't know about all that........

Yes, profits are up, but companies are sitting on a TON of cash because of restrictive regulatory environment......

Labor market is better than the depths on 2009 but have a LONG ways to go.

Greece is not "over"........it is merely hibernating........wait until he hit austerity in the US...........

Difference of opinon makes a market, I guess.

I don't really buy this narative. Companies are sitting on a lot of cash because they are able to meet demand with their existing capacity, and they also fearful of any uptick in demand being temorary.

It doesn't make sense to build factories and hire people when you are able to produce everything you can sell with the factories and people you already employ.

I'm very encourage by the last few positive jobs reports, as it indicates that companies are seeing demand beyond their existing capacity to meet. That could translate into a very virtuous cycle over the next few years if nothing derails it.

It doesn't make sense to build factories and hire people when you are able to produce everything you can sell with the factories and people you already employ.

I'm very encourage by the last few positive jobs reports, as it indicates that companies are seeing demand beyond their existing capacity to meet. That could translate into a very virtuous cycle over the next few years if nothing derails it.

Yes, profits are up, but companies are sitting on a TON of cash because of restrictive regulatory environment......

Not sure about the media, but I agree the US economy - and the global economy - is on a steady but slow path of growth, and risk is falling. US real wages continue to fall ever so slightly, which is painful for many but good for longer term employment prospects and business profits.Hmmm, I am beginning to think that a lot of people have become reflexively pessimistic over the last several years. I see lots of things moving in the right direction: profits, labor market, funding conditions, etc. With hthe Greece exchange in the rearview mirror, perhaps some of these positive developments will occupy more of the media's attention.

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Not sure about the media, but I agree the US economy - and the global economy - is on a steady but slow path of growth, and risk is falling. US real wages continue to fall ever so slightly, which is painful for many but good for longer term employment prospects and business profits.

I see credit market conditions improving meaningfully as well. The investment grade market is wide open and investors are thrusting cash at such issuers. Junk spreads have been dropping to the point where it is attractive for many junk issuers to refinance or pound out new bonds. The bank loan market also seems to be easing somewhat based on a few refinancings/amendments that allow for much more borrower flexibility and often a lower cost of funds.

And, the two biggest bankers in the world have said they will bet the house to keep credit markets on this path for a good while longer. My sense is the US is in a better situation vs the rest of the world than it as been for a long while, and it is still improving.I see credit market conditions improving meaningfully as well. The investment grade market is wide open and investors are thrusting cash at such issuers. Junk spreads have been dropping to the point where it is attractive for many junk issuers to refinance or pound out new bonds. The bank loan market also seems to be easing somewhat based on a few refinancings/amendments that allow for much more borrower flexibility and often a lower cost of funds.

The risk reward ratio is skewed but I think many investors are thinking asset prices are too high when that is not clear. They may be high, but the risk of loss of purchasing power is catching up.

Coolius

Full time employment: Posting here.

- Joined

- May 15, 2010

- Messages

- 862

As I navigate through many Stock and investor forums, the sense is quite widespread that the market is due for a precipitous decline. A lot of people appear to be shifting into cash.

I read about people who are 86% cash, 50% cash, and a majority being 35% cash. All this is not earning them anything, while inflation continues ( gas prices, groceries, taxes ) so they are losing as they hold cash each day.

Although I am not fully invested, my own take is that this sidelined cash will have to be put to use in some way, and fairly soon. The market has risen since December, and folks are still running scared and hoarding cash. One day they will have to start putting it to work, because inflation and living is not being sidelined.

There will probably be a couple of declines, nothing too serious is my belief, and I intend to buy solid blue chips at that time, then hang on and count on the dividend yield. If the market goes up, I may take the CGs, but if not, I continue to use the dividends to survive.

In summary, I think there will be a breakout to the 14,000 level before we see a drop back to the 12,000 levels. So I am not lightening up at this time.

I read about people who are 86% cash, 50% cash, and a majority being 35% cash. All this is not earning them anything, while inflation continues ( gas prices, groceries, taxes ) so they are losing as they hold cash each day.

Although I am not fully invested, my own take is that this sidelined cash will have to be put to use in some way, and fairly soon. The market has risen since December, and folks are still running scared and hoarding cash. One day they will have to start putting it to work, because inflation and living is not being sidelined.

There will probably be a couple of declines, nothing too serious is my belief, and I intend to buy solid blue chips at that time, then hang on and count on the dividend yield. If the market goes up, I may take the CGs, but if not, I continue to use the dividends to survive.

In summary, I think there will be a breakout to the 14,000 level before we see a drop back to the 12,000 levels. So I am not lightening up at this time.

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Bullish? No

Holding stocks? Yes

Why? Taxes, committment to oil and gas long term, and hassles and onerous tax costs of selling MLPs, particularly partial postions.

Besides which, while no longer bargains, my stocks are not overpriced. However, long experience has taught me that this is scant protection from a general market decline.

Ha

Holding stocks? Yes

Why? Taxes, committment to oil and gas long term, and hassles and onerous tax costs of selling MLPs, particularly partial postions.

Besides which, while no longer bargains, my stocks are not overpriced. However, long experience has taught me that this is scant protection from a general market decline.

Ha

Last edited:

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Bullish? No

Holding stocks? Yes

Why? Taxes, committment to oil and gas long term, and hassles and onerous tax costs of selling MLPs, particularly partial postions.

Besides which, while no longer bargains, my stocks are not overpriced. However, long experience has taught me that this is scant protection from a general market decline.

Ha

You can always hedge, Ha. Wait until the VIX calms down a bit and load up...

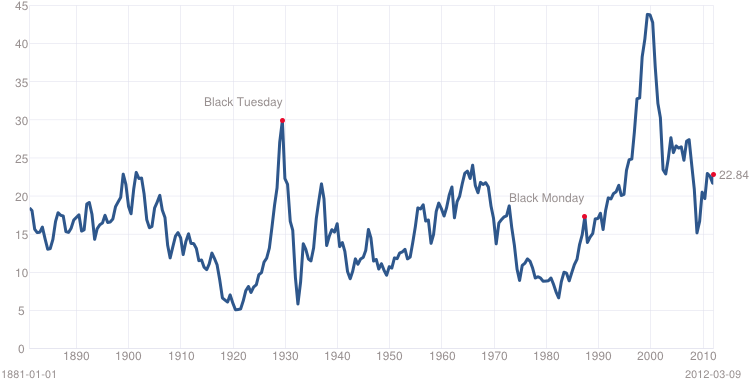

Any thoughts on this chart? With a historical average market PE of about 16, the market looks a little overpriced. Of course, that didn't mean anything in the 90's or the 20's but there weren't many other periods in the last 100 years or so that were priced higher. I don't really have much experience with chart reading and I generally follow some basic rules of investing... choose a diversified mix of investments and rebalance your portfolio regularly to maintain the asset allocation. That said, not overpaying for an asset is also a good rule of thumb and it looks like the market is getting expensive. I've also seen charts and research that show we're only about halfway through a cyclical bear market that started in 2000 (couldn't find one to share unfortunately). Not sure how I feel about that as it's still all theory. My time horizon is very long so I'm not making major changes to my investment strategy, but I have made some slight adjustments. I'd love to get feedback from someone who follows this kind of data and has an opinion.

Attachments

In a tax deferred account.You can always hedge, Ha. Wait until the VIX calms down a bit and load up...

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

In a tax deferred account.

If the poop hits the windmill and the puts come into the money in a significant way, you will have plenty of losses to offset your options gains.

Similar threads

- Replies

- 26

- Views

- 892

- Replies

- 24

- Views

- 2K