copyright1997reloaded

Thinks s/he gets paid by the post

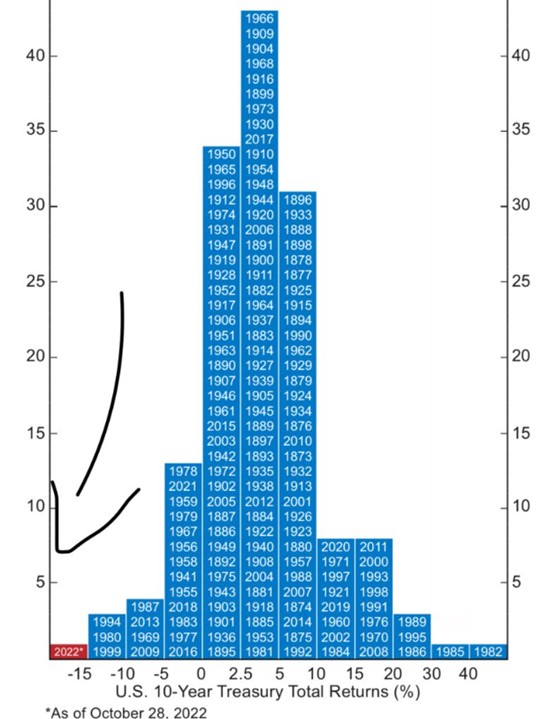

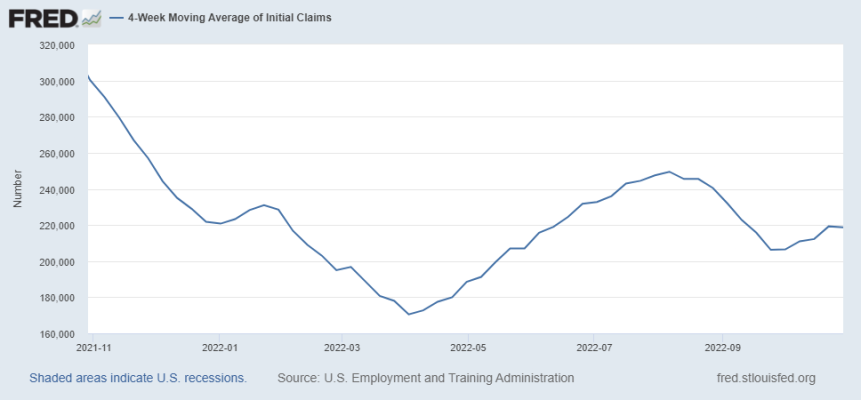

Hmm. If you look at the data here:

https://home.treasury.gov/resource-...reasury_yield_curve&field_tdr_date_value=2022

It shows the 3/10 initially inverting in the middle of June and being persistently inverted since the middle of July. I'm not sure why there is a difference.

3 month, not the 3 year.