You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Chart of the Day

- Thread starter Running_Man

- Start date

copyright1997reloaded

Thinks s/he gets paid by the post

Average Homebuyer Payment based on median asking price. Getting expensive

And yet I keep seeing many folks out there saying "housing prices will remain strong and go up even more due to the lack of supply".

They may be right, but I wouldn't (and am not) betting on it. This chart is NOT their friend.

And yet I keep seeing many folks out there saying "housing prices will remain strong and go up even more due to the lack of supply".

They may be right, but I wouldn't (and am not) betting on it. This chart is NOT their friend.

Compare the payment relative to median household income in the US vs in most other developed countries. Still dirt cheap relatively speaking in the US. If rent prices weren’t soaring, construction costs weren’t soaring and supply at record lows I would agree with you, but I think it’s as likely we go the route of Europe, Canada, Australia etc where only 40-50% can afford to own vs the 65% we have in the US today.

That payment is at 35% of median household income, prob 25% of median household buyers excluding renters. Still very affordable and 20% are all cash don’t forget. Price growth will slow but not reverse (at least nationally)

copyright1997reloaded

Thinks s/he gets paid by the post

Price growth will slow but not reverse (at least nationally)

Do you believe this will be true in real terms (i.e. adjusted for inflation)?

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Compare the payment relative to median household income in the US vs in most other developed countries. Still dirt cheap relatively speaking in the US. If rent prices weren’t soaring, construction costs weren’t soaring and supply at record lows I would agree with you, but I think it’s as likely we go the route of Europe, Canada, Australia etc where only 40-50% can afford to own vs the 65% we have in the US today.

That payment is at 35% of median household income, prob 25% of median household buyers excluding renters. Still very affordable and 20% are all cash don’t forget. Price growth will slow but not reverse (at least nationally)

In Canada, home ownership has been as high (or higher) as the USA for decades, even though mortgages are non-deductible.

<edit> Renters in some Provinces get a credit on their tax return of ~$250 , yet the ownership in the one Province of Ontario that I know is high.

Home Ownership Rate in Canada increased to 68.55 percent in 2018

Last edited:

On the housing markets in other countries, there are not really any other comparable ones to the US's because there is just so much room to build in a decent climate. Canadians for example are practically forced to live on the border with the US, their densely populated areas probably only equate to the size of California. Australia has a hot market, but the vast majority of it is uninhabitable. The only thing comparable is China, where they are in the mother of all housing bubbles.

Do you believe this will be true in real terms (i.e. adjusted for inflation)?

Tough to say, but housing does really well in inflationary periods. I think it will outperform stocks as for rentals (and it has the last two years). Look how well housing did in the 70s and 80s even with rapidly rising rates, much higher than today. Add in strong (and rising) cash yields on my rentals and paying down principal each month, and I'm yielding 30-35% annual returns even at 3% appreciation, to say nothing if it grows faster than 3% nominally. I would love for prices to drop though - I will back up the truck on rentals.

Plex - the US has a ton of land but NOT in places where people want to live. Most of the larger metro cities (say top 30) are having to build way outside of the city. Here in Charlotte, they've already started to run out of land in Fort mill and Indian Land in SC after growing like crazy here the last 12 years just outside of Charlotte and are now going further out to Lancaster, etc. That's a good 30 miles+ from the city center and not even the same state. Same story in Raleigh and Atlanta etc. Australia technically has a ton of land available as well, but not many areas that are inhabitable and that folks want to live in. The same is largely true in the US, moreso on where folks want to live than uninhabitable. And worse - new build construction cost is way higher than existing stock even with these price increases so its not like we can easily build our way out of this.

Last edited:

copyright1997reloaded

Thinks s/he gets paid by the post

Tough to say, but housing does really well in inflationary periods. I think it will outperform stocks as for rentals (and it has the last two years). Look how well housing did in the 70s and 80s even with rapidly rising rates, much higher than today. Add in strong (and rising) cash yields and paying down principal each month, and I'm yielding 30-35% annual returns even at 3% appreciation, to say nothing if it grows faster than 3% nominally.

Plex - the US has a ton of land but NOT in places where people want to live. Most of the larger metro cities (say top 30) are having to build way outside of the city. Here in Charlotte, they've already started to run out of land in Fort mill and Indian Land in SC after growing like crazy here the last 12 years just outside of Charlotte and are now going further out to Lancaster, etc. That's a good 30 miles+ from the city center and not even the same state. Same story in Raleigh and Atlanta etc. Australia technically has a ton of land available as well, but not many areas that are inhabitable and that folks want to live in. The same is largely true in the US, moreso on where folks want to live than uninhabitable. And worse - new build construction cost is way higher than existing stock even with these price increases so its not like we can easily build our way out of this.

This will be an interesting one to watch play out. Stagflation times (e.g. 70's) was a good time for housing, and yes it should do well in an inflationary environment. But I think there is a chance of a delayed ka-boom kind of thing - housing does OK until the recession really starts to bite and then prices stabilize/fall. Fed gives into pressure to "fulfill their employment mandate" as recession deepens and inflation "moderates", again resulting in more $ creation...and we then are off to the races again in terms of inflation and prices of real things (like real estate).

On Friday I opened a "tracker" on $SRS, Pro-shares ultra-short real estate just as a way for it to be in my portfolio as a daily reminder. (A nice thing about commission free trading, buying one share just to watch is easy.) I am in no way recommending this as an investment play.

I'm also pondering the re-fi market and ways to play it slowing. With increased rates and perhaps an upcoming less robust economic environment, we might see the re-fi market dramatically fall. This will also hurt realtors and others who make money in turning houses - people will be more reluctant to sell/move if it means replacing their current low interest rate mortgage with a higher interest rate one.

On Friday I opened a "tracker" on $SRS, Pro-shares ultra-short real estate just as a way for it to be in my portfolio as a daily reminder. (A nice thing about commission free trading, buying one share just to watch is easy.) I am in no way recommending this as an investment play.

.

Public REITs in no shape way mirror or track the massively larger private real estate market and are actually terrible hedges to stocks for that reason. Public REITs multiples contract and expand exactly like all other stocks do, usually at the same time as other stocks.

Private real estate valuations however move very slowly by comparison - usually tracking cash flow or cap rates. Blackstone has made a killing the last 3 cycles taking advantage of this - buying public real estate companies at the beginning of a cycle after public valuations have tanked and selling them 4-5 years later when public multiples have massively expanded. My last firm was with a company they have now bought (3x) and sold 2x times in the last 20 years (currently own them again after buying them in the pandemic).

Additionally, by far the largest market for real estate is residential/apartment real estate and there are very limited investments in public REITs for that.

Last edited:

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

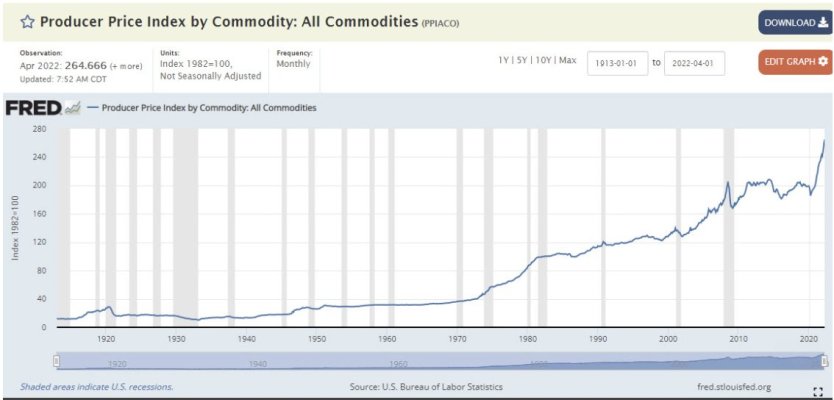

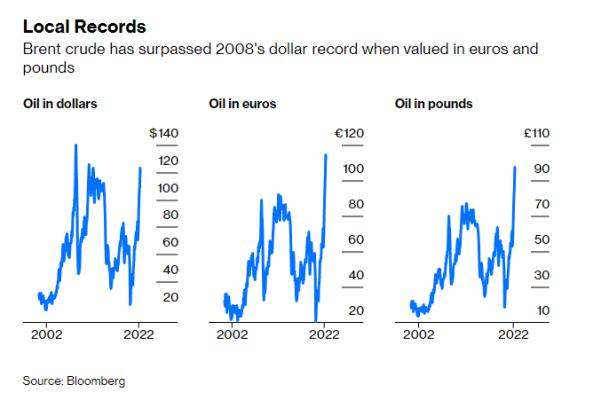

Yes, commodity price increase is the main cause of inflation worldwide: from fuel costs to metals and other natural resources.

My semiconductor stocks are beaten down badly, but it helps for me to own some oil and gas stocks, plus industrial metal and mining stocks. Phosphate and potash miners are going strong.

My semiconductor stocks are beaten down badly, but it helps for me to own some oil and gas stocks, plus industrial metal and mining stocks. Phosphate and potash miners are going strong.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

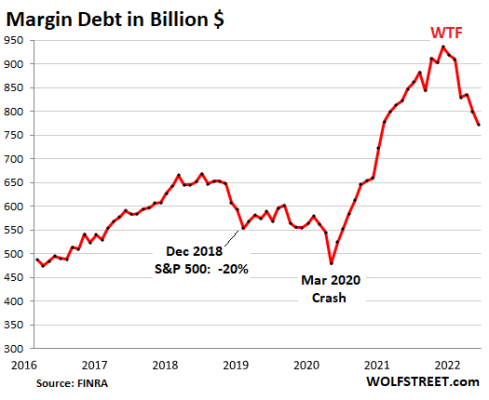

Wow!

The silver lining is that the 1.5 trillion is not worth as much as it used to be.

The silver lining is that the 1.5 trillion is not worth as much as it used to be.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Is this chart inflation adjusted?

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Is this chart inflation adjusted?

No this is actual price.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

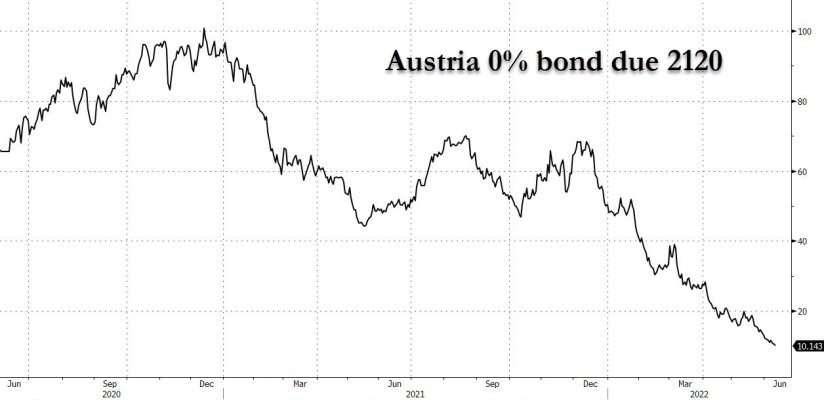

This bond was discussed in this forum previously. Now down 90% from issueance.

Nice!

And this after only 2 years. Still has 98 more years to go.

PS. Did we find out who the bond holders are? Who in their right mind would lock up their money for 100 years in exchange of a guarantee of 0% interest for that long? They were expecting 100 years of deflation?

Last edited:

copyright1997reloaded

Thinks s/he gets paid by the post

This bond was discussed in this forum previously. Now down 90% from issueance.

So does this now have a 2% Yield to Maturity?

aja8888

Moderator Emeritus

So does this now have a 2% Yield to Maturity?

You can buy it but will have a bit of trouble selling it.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

So does this now have a 2% Yield to Maturity?

Good point about the YTM!

I just computed it to be 2.36%.

Buy, buy, buy...

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

Primary owner are passive bond funds. The issuance of 2.2 Billion was oversubscribed by 10 billion dollars in requests from "investors" Primarily passive bond funds, pension funds and hedge funds to be used as a hedge againt falling rates. Because they are govenment bonds, Austria has a total of about 10 billion in 100 year bonds, pension funds in Austria by law are required to hold them.Nice!

And this after only 2 years. Still has 98 more years to go.

PS. Did we find out who the bond holders are? Who in their right mind would lock up their money for 100 years in exchange of a guarantee of 0% interest for that long? They were expecting 100 years of deflation?

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Primary owner are passive bond funds. The issuance of 2.2 Billion was oversubscribed by 10 billion dollars in requests from "investors" Primarily passive bond funds, pension funds and hedge funds to be used as a hedge againt falling rates. Because they are govenment bonds, Austria has a total of about 10 billion in 100 year bonds, pension funds in Austria by law are required to hold them.

Well, if they don't have to sell, then they don't lose.

I wonder if they have to do mark-to-market accounting. That hurts.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

I suspect they do what Ishares did which is to sell the shares buy another long term then buy them back at current market price to hide the loss. They are showing 1 million in 100 year Australian bonds - probably 10 million originally or about 1/2 percent of the total issuance and yet show only net loss of $7,000. Must account for bonds on FIFO method.Well, if they don't have to sell, then they don't lose.It's just that in 100 years, their bonds will be worth less than 1c.

I wonder if they have to do mark-to-market accounting. That hurts.

Last edited:

Similar threads

- Replies

- 21

- Views

- 2K

- Replies

- 1

- Views

- 382