Katoslake

Recycles dryer sheets

Hello,

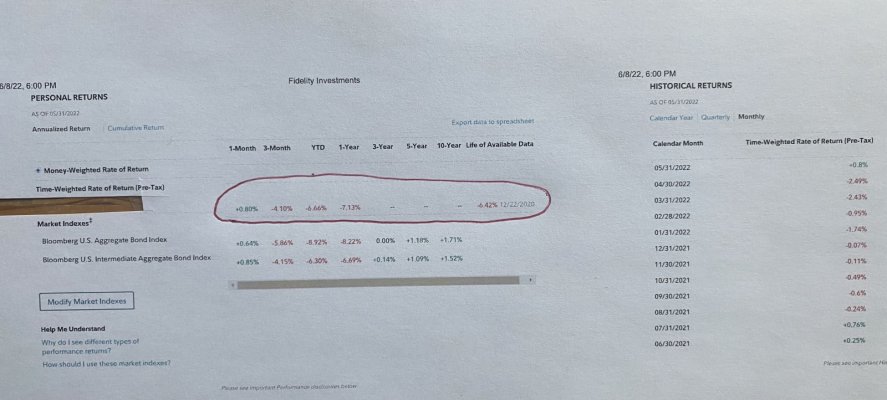

We have a 37% allocation in individual bonds which are actively managed by Fidelity. Have a meeting tomorrow with advisor to discuss potential changes. They charge a management fee of .45.

Any thoughts would be greatly appreciated !

Thanks

We have a 37% allocation in individual bonds which are actively managed by Fidelity. Have a meeting tomorrow with advisor to discuss potential changes. They charge a management fee of .45.

Any thoughts would be greatly appreciated !

Thanks