Katoslake

Recycles dryer sheets

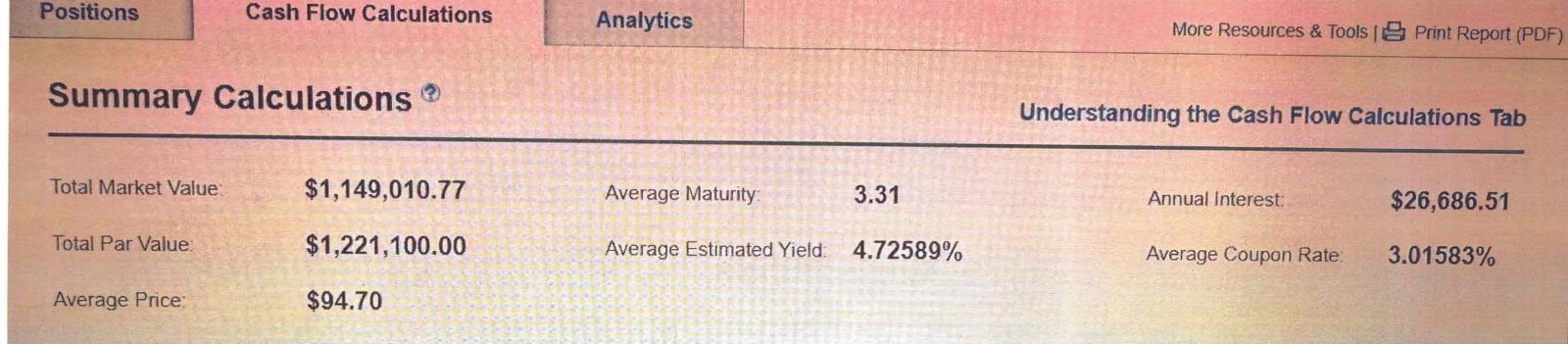

Attached are the positions in my Fidelity bond account.

This account was constructed by the Fidelity managed bond team. I have since terminated their management of this account.

The CD's were purchased by me.

Any thoughts or advice will be appreciated !

This account was constructed by the Fidelity managed bond team. I have since terminated their management of this account.

The CD's were purchased by me.

Any thoughts or advice will be appreciated !

Last edited by a moderator: