Another little note, I noticed the last time we had a correction, this forums "# of active users" spiked to an all time high. Which makes sense, the VIX heads up, people start logging on to their trusted sources to understand the volatility (fear).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How is this NOT a US Stock bubble??

- Thread starter RenoJay

- Start date

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Something strange I've noticed the past year or so. MOST days Pre-market opens down...we always eek it out in the green. I don't exactly track this but it seems like that is the case lately. I never use pre-market as a leading indicator of how the day will end because of that observation. Also, I never time the market so there is that.

I agree up to a certain point.

IIRC, when the pre market open 75 bps or more down, it usually ends up down.

Let's see today.

FWIW, heard investor Leon Cooperman (he's the investor that had a little quarrel with Elizabeth Warren a little while back) on the tube today, and says he thought that bond market was closer to a bubble than the stock market right now. Thought there were some things like Tesla, etc that were in euphoric state, and while he could see a correction in the near term, doesn't feel the conditions or backdrop for a big drop in the market are there at this time.

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 889

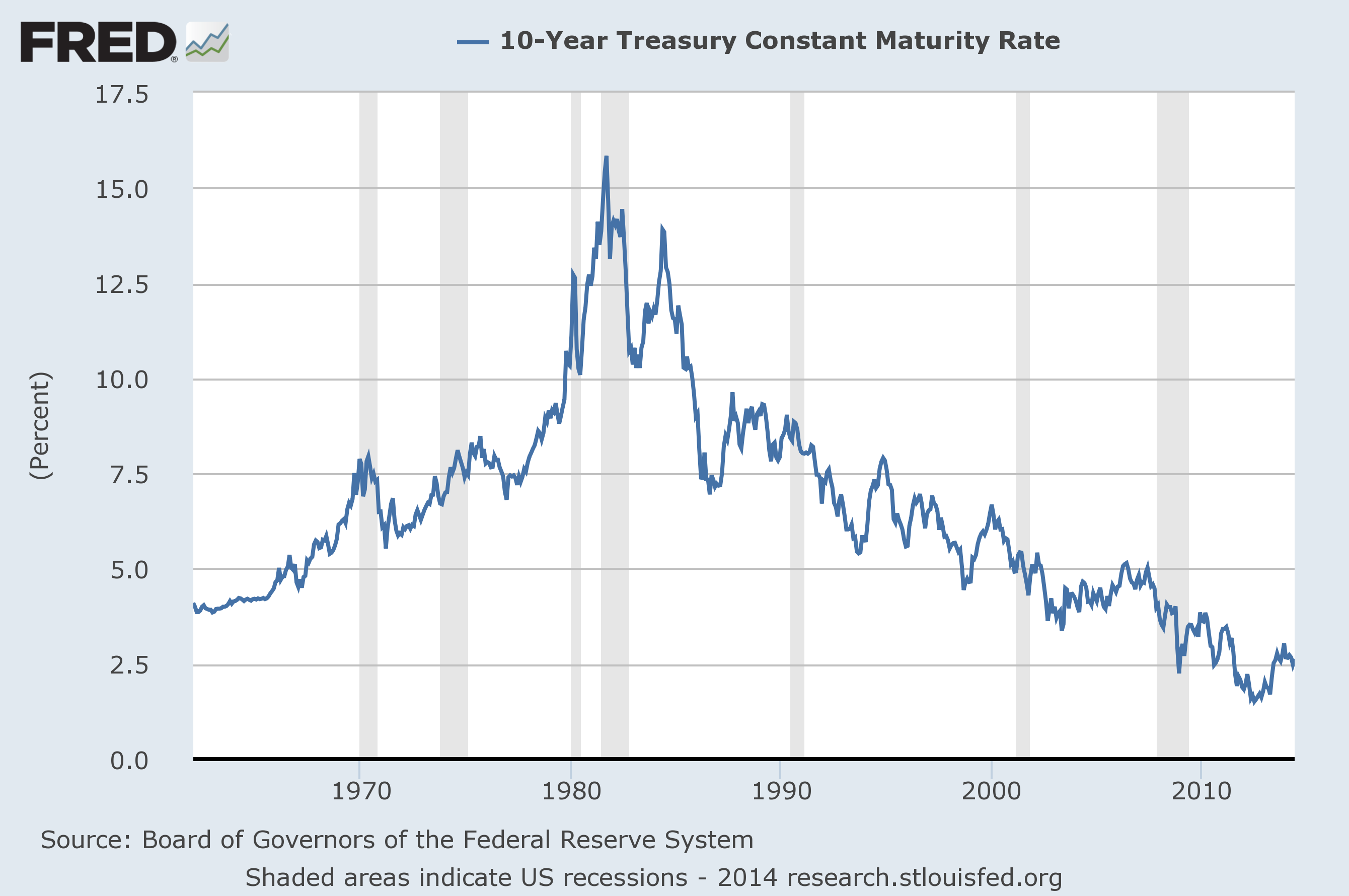

As long as the Federal Reserve continues to halve the long term treasury rate every decade stock prices will maintain, though I think the impact is less over time. What would the market do if long term US treasury interest rates doubled every decade for the next 40 years next? Bicycling is easy with a 20 mile an hour wind to your back.

The fed doesn’t set the long term rates as you know. The market does. All the fed can do as we saw in the Gfc is buy their own debt to try to keep the yield down. But their ability to actually control it is limited.

Given where the other major economics are with long term rates I don’t see them rising significantly anytime soon. The only thing that will change this is if investors abandon fiat currencies in general. We are a long way from anything like that but it could happen.

Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

The fed doesn’t set the long term rates as you know. The market does. All the fed can do as we saw in the Gfc is buy their own debt to try to keep the yield down. But their ability to actually control it is limited.

Given where the other major economics are with long term rates I don’t see them rising significantly anytime soon. The only thing that will change this is if investors abandon fiat currencies in general. We are a long way from anything like that but it could happen.

In 1979 Volker was named Fed Chairman he maintained rates were too low, with rates at 8% when he was named chairman they went up to 10% in 1980 when overnight he raised the Fed Funds rate to 20% from 10%. Long term rates eventually peaked with the Fed Funds rate in December of 1981@20% while long term bonds peaked at 15%,

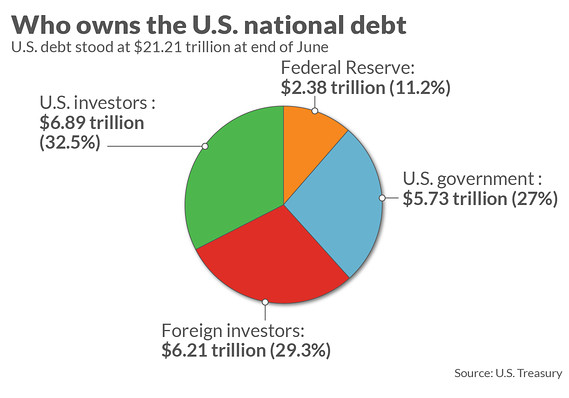

The Fed has broad influence over the entire interest rate market and no one is going to buy a 3% 30 year treasury if you can get a 20% 3 month T-bill. Both short term and long term rates have since spent 40 years in a steady decline as the Fed has consistently lowered short term rates, once they reached the bottom they began QE and buying of actual debt to continue the long term interest rate decline. The Fed presently owns 11% of all debt of the United States government and SS & Federal Pensions own another 27 percent.

The purpose of quantitative easing was to lower long term rates by reducing supply and is being copied by banks world wide. Japan is presently buying 70% of all bond issuance with the stated goal of keeping long term rates at 0.10%. The Fed ended the tapering and resumed buying bonds again in order to stop the rise in long term interest rates that occurred in the 4th quarter of 2018.

"investors" own a pitifully small amount of US Debt and have limited influence on rates. "Foreign Investors" are primarily central banks of foreign countries.

Last edited:

Markola

Thinks s/he gets paid by the post

+1 sometimes the objective is not to win.... but rather.... the objective is to NOT lose.

And like many things in life everything in moderation and nothing in excess.

Words to invest by. This is why various mid-range stock/bond asset allocations all work out to nearly the same place over 20 year cycles or longer. I’m 54 and never thought we’d be in a 52/48 allocation already but we’re starting to lean on our portfolio for a quarter of our income, so it just makes sense to avoid so much stock drama as we used to endure.

Last edited:

leftyfrizzell1963

Dryer sheet aficionado

- Joined

- Aug 7, 2018

- Messages

- 43

Apple just posted an announcement that earnings will be lower due to the CV. Could this be the start of a major downturn tomorrow morning?

Market down over a 1,000 points, the 2nd biggest point drop in history. I guess it took a week for this and similar announcements to take effect. I think there are some deals out there now. I hope it bounces back tomorrow by others thinking the same.

ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Market down over a 1,000 points, the 2nd biggest point drop in history. I guess it took a week for this and similar announcements to take effect. I think there are some deals out there now. I hope it bounces back tomorrow by others thinking the same.

Couple things...points mean nothing; percentage is what matters. Second, unless you are a day trader, what the market does "today/tomorrow/this week/this month" should be fairly inconsequential. Ignore it? Of course not...but staying off CNBC is probably a good idea.

Market down over a 1,000 points, the 2nd biggest point drop in history. I guess it took a week for this and similar announcements to take effect. I think there are some deals out there now. I hope it bounces back tomorrow by others thinking the same.

It's days like this that I'm glad I recently went to 42% equities - down from 80%.

As the COVID-19 takes hold, it could drop a lot more.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was totally unaware until about an hour ago when my BIL told me. No problem, if anything perhaps a buying opportunity. I'll have to take a look and see what today did to my AA tonight.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Buy your snow gear in summer and your straw hats in winter.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

You are like the gambler who only humble brags about how much they won, ignoring how much they lost along the way.It's days like this that I'm glad I recently went to 42% equities - down from 80%.

As the COVID-19 takes hold, it could drop a lot more.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It's days like this that I'm glad I recently went to 42% equities - down from 80%.

As the COVID-19 takes hold, it could drop a lot more.

And then what?

As I was reminded about the now common Just-in-Time inventory levels, I could see how this could have a very big impact on the economy. But over time, things will normalize.

I'm a long term investor, with an AA that will support many many years of selling off bonds w/o ever touching the principal in my equities. So when the market recovers, I'm fine.

Maybe some will be able to time an exit and entry? Good luck, I'm not going to try to play that game.

-ERD50

You are like the gambler who only humble brags about how much they won, ignoring how much they lost along the way.

Not really accurate. I went from 72% to 50% equities yesterday. Everything I sold was a gain.

Sure, that 22% might not make as much now. That’s ok. But that’s hardly a “loss.”

I doubt you’ll agree though, and that’s ok too.

- Joined

- Apr 14, 2006

- Messages

- 23,071

By pure serendipity, I sold my entire taxable stock position the last week of January in order to capture some 0% long term capital gains in what will be the lowest income year for us for the rest of our lives. I just never got around to reinvesting it, so now I do have a large cash position. At least four to five years' worth of spending. Sometimes better to be lucky than smart. If I had been smart, I would have moved the money in my old 457b and 401k to the stable value option. Alas, I did not, so I'll just have to wait it out there.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Right now you are identical to the gambler example I gave. SMHNot really accurate. I went from 72% to 50% equities yesterday. Everything I sold was a gain.

Sure, that 22% might not make as much now. That’s ok. But that’s hardly a “loss.”

I doubt you’ll agree though, and that’s ok too.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

The real evaluation will be complete when you get back in. If you miss the run up you are no further ahead. There were many back in 2008 who managed to get out before the drops, but they missed out on getting back in and came out behind. Time will tell.By pure serendipity, I sold my entire taxable stock position the last week of January in order to capture some 0% long term capital gains in what will be the lowest income year for us for the rest of our lives. I just never got around to reinvesting it, so now I do have a large cash position. At least four to five years' worth of spending. Sometimes better to be lucky than smart. If I had been smart, I would have moved the money in my old 457b and 401k to the stable value option. Alas, I did not, so I'll just have to wait it out there.

VanWinkle

Thinks s/he gets paid by the post

The reason the stock market is going down is because there are more sellers than buyers. This is due to panic selling by people that think they are saving themselves from some dire consequences. They convince themselves that they are just taking profits that they should have taken months ago. If you are selling to preserve, you are the reason the market is going down because you are not alone. I am not selling to help prop up the market a little tiny bit for everyone else out there. I hope there are more that are willing to do their part.

P>S> If I do sell, it be to tax loss harvest and I promise to re-invest it the same day

VW

P>S> If I do sell, it be to tax loss harvest and I promise to re-invest it the same day

VW

The reason the stock market is going down is because there are more sellers than buyers.

No, but there are people wanting to sell and not enough buyers at their asking price. Each sold share needs a buyer.

I know what you mean-but that jargon gets me every time.

Last edited:

VanWinkle

Thinks s/he gets paid by the post

No, but there are people wanting to sell and not enough buyers at their asking price. Each sold share needs a buyer.

I know what you mean-but that jargon gets me every time.

Ok, I stand corrected, but I am glad you got the meaning!!

Right now you are identical to the gambler example I gave. SMH

Except I haven’t lost?

As I said, we won’t agree and that’s ok.

It's days like this that I'm glad I recently went to 42% equities - down from 80%.

As the COVID-19 takes hold, it could drop a lot more.

You are like the gambler who only humble brags about how much they won, ignoring how much they lost along the way.

Hmmm. I'm not seeing that at all. I haven't bragged about how much I won. In fact, I lost about $50,000 in equity yesterday despite my AA, which I adjusted over time after I had already hit my target stash in the last year and a half, and I have stated I've been at this AA in quite a few previous posts. I definitely wouldn't call myself a gambler because I tend to be pretty conservative at this point in my life.

It's days like this that I'm glad I recently went to 42% equities - down from 80%.

As the COVID-19 takes hold, it could drop a lot more.

And then what?

For COVID-19, we will have to see. The market already dropped a lot more since my previous post, and we're still in the early stages of this outbreak.

For me, I'll hold steady and rebalance at some point if my AA gets out of whack and may eventually do a rising equity glide path after I FIRE. I'm not panicking.

Last edited:

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

If you don't time the market getting back in, you'll have lost, and chances are you won't tell us that.Except I haven’t lost?

As I said, we won’t agree and that’s ok.

Talk to people from 2007/8 and missed timing of when to get back in.

dixonge

Thinks s/he gets paid by the post

Finally finished taxes and my Roth conversion cost me less than I had anticipated, so ... dry powder! Will wait until just before tomorrow's open to add shares just so I can more easily determine how many shares I can afford. Hasta mañana!

Similar threads

- Replies

- 4

- Views

- 669

- Replies

- 24

- Views

- 2K

- Replies

- 20

- Views

- 1K