Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Re: Returns on I Bonds. Maybe I was too obscure

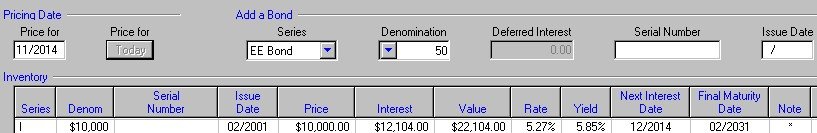

this was a comparison of a $10,000 bond bought in 2001, when the base rate was 3.4%

Compared to CPI inflation from 2001 to 2014... $13,452

Compared to the DJIA $10,000 in 2001 equals $16287 today

The I Bond is now worth $21736.

Who do ya trust?

No doubt I would love your 3.4% fixed I Bonds. Are you including all the dividends from the Dow the past 13 years though in your calculation? If not I imagine that would change it by a decent amount.

Sent from my iPad using Tapatalk