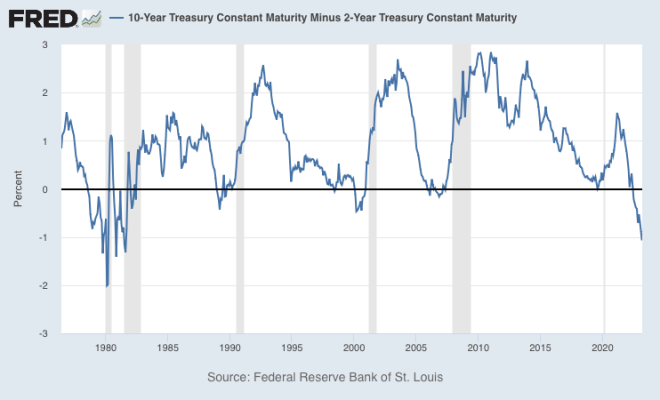

Yield curve inversion reached a record yesterday, over 103 basis points between the 2 and 10 year treasury yields.

Strong recession predictor.

And interesting how long rates barely budge as Fed hikes.

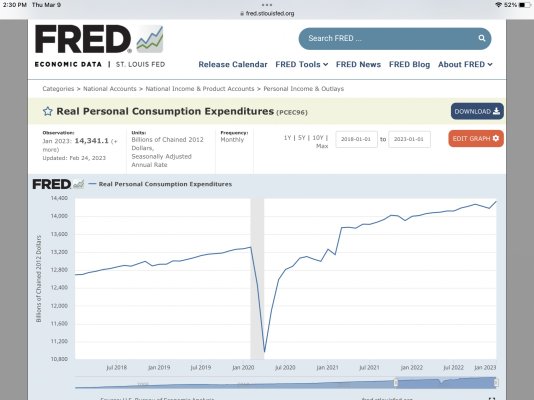

Very interesting to say the least. Several economic reports coming out in the next week that will clearly affect this one way or the other.

Last edited: