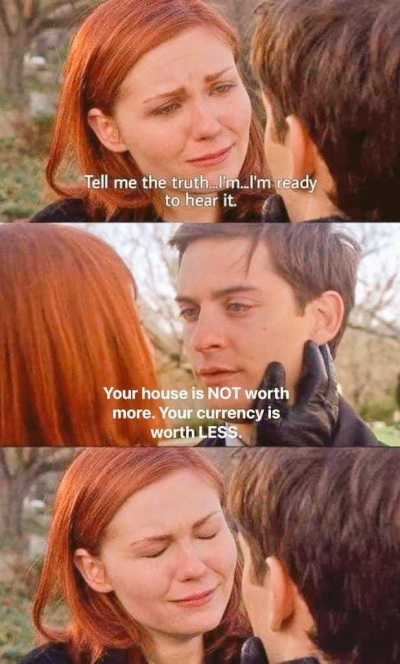

Anyone else bumping up on the $500,000 per couple primary residence exclusion and wondering if they should sell and move?

Per the IRS: If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. The exclusion is increased to $500,000 for a married couple filing jointly.

We are at that point (maybe beyond), and I would hate to wait 5 or 10 years and learn that the government gets to share in even more inflation generated equity, as the person selling me my next home is not going to give me a special credit for the equity lost to the government.

I know it sounds like a dumb reason to move, but the kids are grown. We don't even use the upstairs, so other than the high cost of finding a replacement property in our hot market, not a bad time to move.

How did you handle the decision?

Per the IRS: If you meet certain conditions, you may exclude the first $250,000 of gain from the sale of your home from your income and avoid paying taxes on it. The exclusion is increased to $500,000 for a married couple filing jointly.

We are at that point (maybe beyond), and I would hate to wait 5 or 10 years and learn that the government gets to share in even more inflation generated equity, as the person selling me my next home is not going to give me a special credit for the equity lost to the government.

I know it sounds like a dumb reason to move, but the kids are grown. We don't even use the upstairs, so other than the high cost of finding a replacement property in our hot market, not a bad time to move.

How did you handle the decision?