Sandy & Shirley

Recycles dryer sheets

Looking for my best shot for some LTCGs over the next 2 years. Our mortgage was completed in 2023, so we have some investment opportunities moving forward.

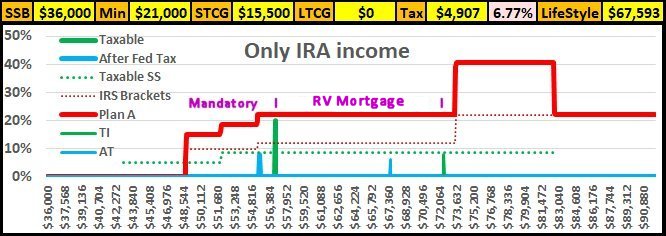

I still have about 40% of my savings in standard IRA, so I will be doing maximum 12% bracket Roth conversions.

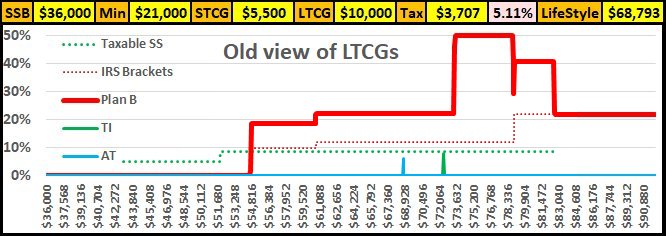

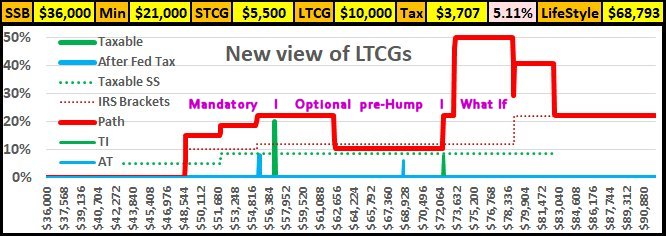

My partner is more than 90% Roth and will be switching from 70% PIA Survivor benefits to 130% personal benefits in 2 years, so we are looking for some good shots at LTCGs for “other investments.

We already have a comfortable level in NVDA which is already up 20% in less than 2 months, but we don’t want to place all of our investments in one basket.

So, what is a good place on the web to look for potential LTCG investments?

I still have about 40% of my savings in standard IRA, so I will be doing maximum 12% bracket Roth conversions.

My partner is more than 90% Roth and will be switching from 70% PIA Survivor benefits to 130% personal benefits in 2 years, so we are looking for some good shots at LTCGs for “other investments.

We already have a comfortable level in NVDA which is already up 20% in less than 2 months, but we don’t want to place all of our investments in one basket.

So, what is a good place on the web to look for potential LTCG investments?