ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I'm up 6 bucks a share and collected $563 in dividends for a total profit of $2818.

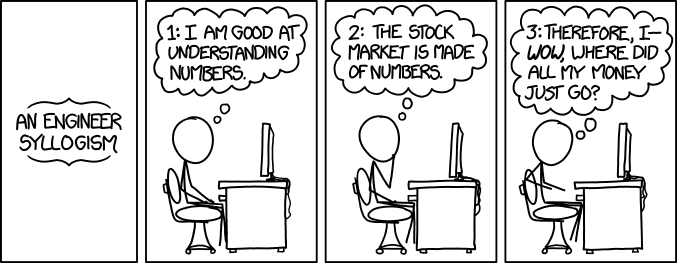

Up 5% in 45 days. Way to go Merrill Lynch -

Roughly the same as SPY in that time - ~ 4.72% (and SPY has a dividend not yet paid out).

Way to go Mr. Market -

-ERD50