Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

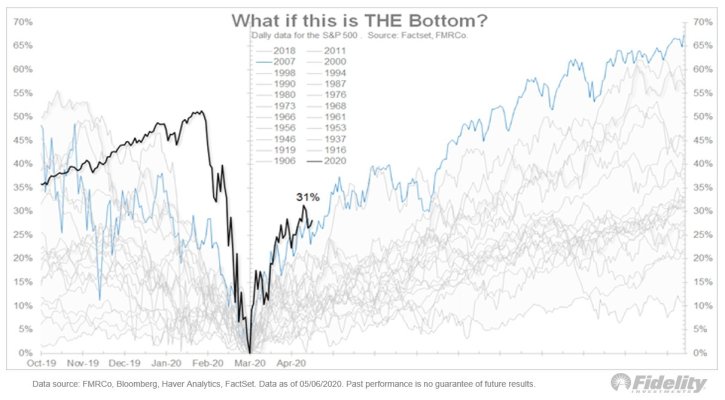

For me this is a scratch-my-head time. This interview with Jeremy Siegel is an interesting bull case study: https://www.cnbc.com/2020/05/08/jer...in-stocks-definitely-going-to-be-the-low.html

Some snippets:

The full 8 minute interview is worth listening to. He discusses the Fed stimulus moves which I'm not qualified to assess.

Siegel mentions he follows this medical doctor, Scott Gottlieb, whose twitter feed is here:

https://twitter.com/ScottGottliebMD?ref_src=twsrc^google|twcamp^serp|twgr^author

I think this is a good source for understanding the present and future direction of the virus.

Some snippets:

Siegel, a longtime stock market bull, said he believes the only way the stock market could retest the March 23 bottom is if there were a more severe coronavirus outbreak in the fall and full-scale lockdowns have to be implemented once again.

“I don’t think that’s going to happen. I think that’s a low-probability event,” he said, while acknowledging the “second wave” of the 1918 Spanish Flu was far more deadly than the initial outbreak.

The full 8 minute interview is worth listening to. He discusses the Fed stimulus moves which I'm not qualified to assess.

Siegel mentions he follows this medical doctor, Scott Gottlieb, whose twitter feed is here:

https://twitter.com/ScottGottliebMD?ref_src=twsrc^google|twcamp^serp|twgr^author

I think this is a good source for understanding the present and future direction of the virus.