Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The capitalization on Total Stock Market is 72/19/9 LC/MC/SC. Wellington and Wellesley seem to do quite well with large caps.

FWIW, our US split is 48/44/8 but is tilted to value stocks. Midcaps seem to do best (compared to large caps) when first coming out of a recession.

FWIW, our US split is 48/44/8 but is tilted to value stocks. Midcaps seem to do best (compared to large caps) when first coming out of a recession.

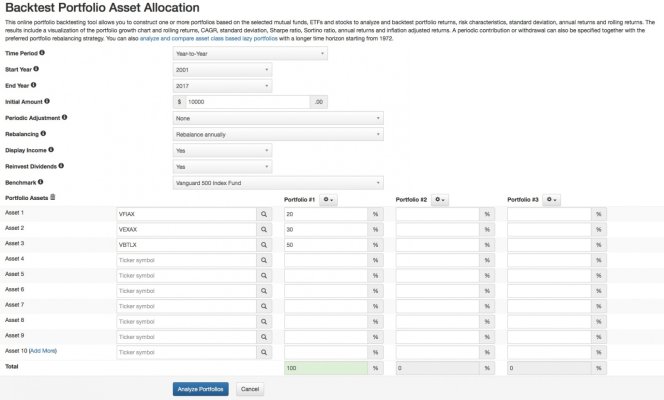

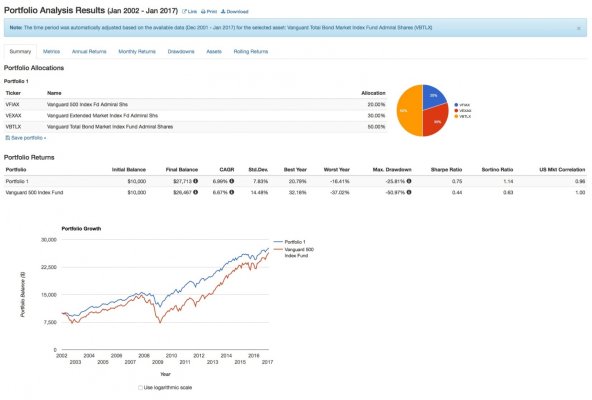

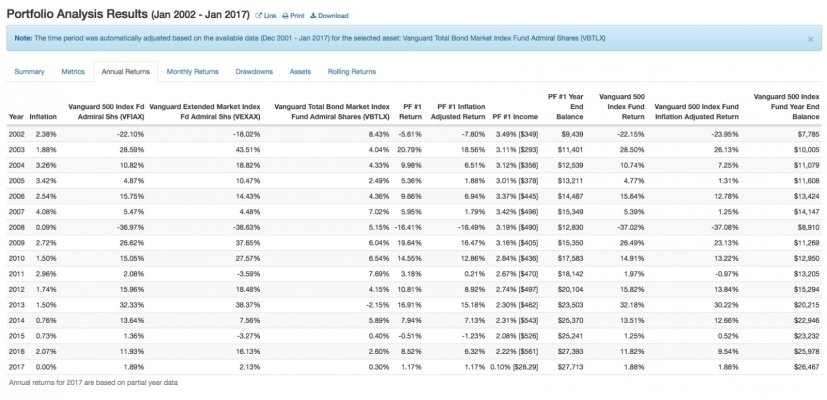

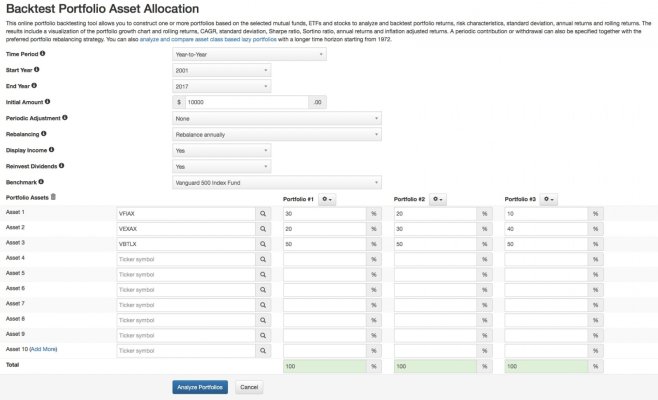

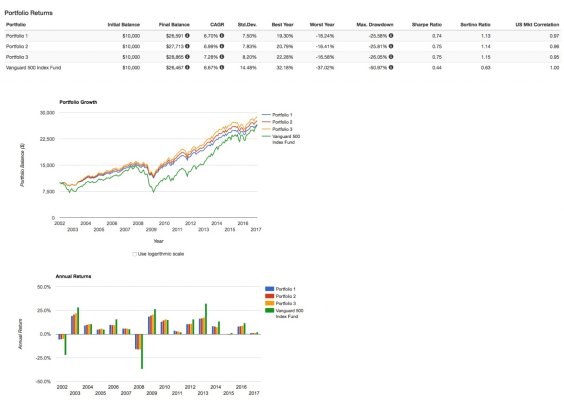

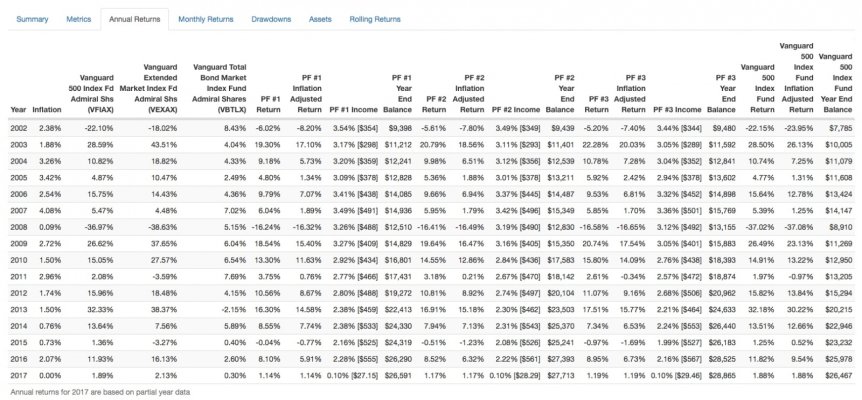

to an IRA. One of the portfolio options I'm considering is shown below. I wanted to get some feedback and thoughts from the community.

to an IRA. One of the portfolio options I'm considering is shown below. I wanted to get some feedback and thoughts from the community.