Hello, I'm preparing to transfer my 401 upon retirement this year,  to an IRA. One of the portfolio options I'm considering is shown below. I wanted to get some feedback and thoughts from the community.

to an IRA. One of the portfolio options I'm considering is shown below. I wanted to get some feedback and thoughts from the community.

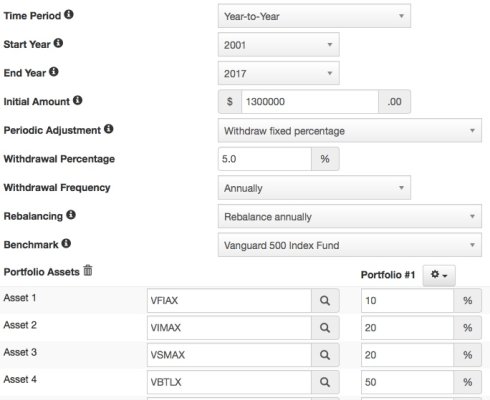

Assumptions:

Portfolio initial balance ~1.3mm

Objective is biased towards captial preservation while allowing an opportunity for growth.

AA is 50/50, rebalanced annually

Investment window is 20-30 years

Annual withdrawal rate would be in the 3-5% range over that period.

Will have a fixed pension that will provide ~30% of the annual budget

SSN will provide ~25% of annual budget

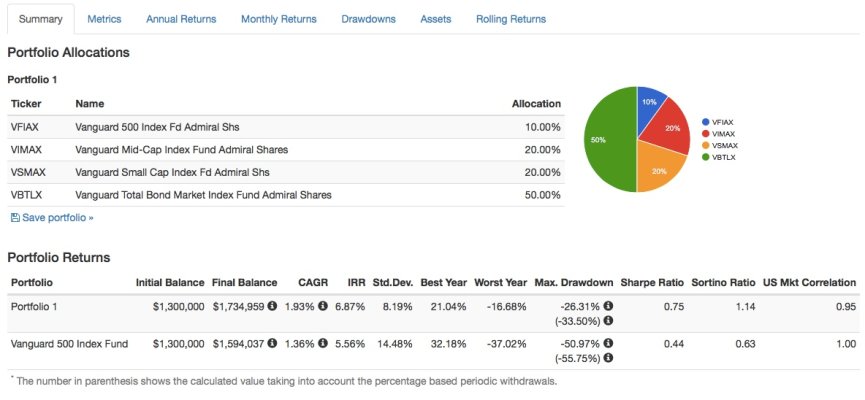

VFIAX: Vanguard 500 Index 10%

VIMAX:Vanguard Mid-Cap Index 20%

VSMAX:Vanguard Sm-Cap Index 20%

VBTLX:Vanguard Total Bond Mkt. Index 50%

Thanks in advance...

to an IRA. One of the portfolio options I'm considering is shown below. I wanted to get some feedback and thoughts from the community.

to an IRA. One of the portfolio options I'm considering is shown below. I wanted to get some feedback and thoughts from the community. Assumptions:

Portfolio initial balance ~1.3mm

Objective is biased towards captial preservation while allowing an opportunity for growth.

AA is 50/50, rebalanced annually

Investment window is 20-30 years

Annual withdrawal rate would be in the 3-5% range over that period.

Will have a fixed pension that will provide ~30% of the annual budget

SSN will provide ~25% of annual budget

VFIAX: Vanguard 500 Index 10%

VIMAX:Vanguard Mid-Cap Index 20%

VSMAX:Vanguard Sm-Cap Index 20%

VBTLX:Vanguard Total Bond Mkt. Index 50%

Thanks in advance...