Ok, I know the argument let stocks be stocks and bonds be bonds, but I am guilty of trying to squeeze out a little extra juice in my bond allocation by owning a small portion of a preferred ETF (PGX). While I for the most part have swallowed the low bond yields by tapping my shoes 3 times and saying over and over "they are a ballast, they are ballast", my greed gland starts pumping and wants a little sugar! I am also reading as of late from the "professionals" like Christine Benz that mixing in a portion of High Dividend Yield stocks is a reasonable way for us junkies to get our fix. For kicks and giggles I compared my PFE to VYM looking at the Total Annual Returns from 2009 - 2019 side by side as well as the current yield. Current yields were 5.11% and 3.62% respectively. VYM beat PFE in Total Return 6 out of 11 years and clearly won overall Total Return for that period. Observation... some years the 2 ETFs acted similarly like stocks and other years PFE acted like a bond (to be expected as I understand). Volatility was roughly the same, maybe slightly higher with VYM. So here's the question, if you buy into the strategy of juicing your bond returns with an "alternative" investment, what are the pros/cons of using Preferred over High Dividend Yield stocks? Or, should I just keep tapping my shoes...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Preferred vs. High Dividend Yield Stocks as Part of Your AA

- Thread starter DawgMan

- Start date

The risk is that if interest rates re-normalize over time you can loose more principle than you made in income.

I'm assuming you are referring to Preferreds, not necessarily High Yield stocks?

I'm also guilty of trying to "juice" the fixed income portion of my AA. In my AA I separate Bonds (BND) and Preferred Stocks into separate categories. For Preferred stocks I use a mixture of individual stocks culled from this and other forums, ETFs, and CEFs. Most of my preferreds have been bought during market drops and I don't intend to "ever" sell some of them so I don't really care very much if they are above or below par at any given time. I had tried at one point the art of flipping preferreds to juice the return but really was not very successful. Unlike others here I was either too greedy, too impatient, didn't invest enough time, or just not skilled enough for flipping to work. I currently have 5X the amount of preferred compared to bonds and often wonder if I should eliminate the bond category entirely.

VanWinkle

Thinks s/he gets paid by the post

I'm also guilty of trying to "juice" the fixed income portion of my AA. In my AA I separate Bonds (BND) and Preferred Stocks into separate categories. For Preferred stocks I use a mixture of individual stocks culled from this and other forums, ETFs, and CEFs. Most of my preferreds have been bought during market drops and I don't intend to "ever" sell some of them so I don't really care very much if they are above or below par at any given time. I had tried at one point the art of flipping preferreds to juice the return but really was not very successful. Unlike others here I was either too greedy, too impatient, didn't invest enough time, or just not skilled enough for flipping to work. I currently have 5X the amount of preferred compared to bonds and often wonder if I should eliminate the bond category entirely.

How long have you used this preferred stock method for income? Do you

count the preferred stocks as part of your equity allocation? What allocation of equities are targeted in your plan?

Thanks for any information.

VW

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

... So here's the question, if you buy into the strategy of juicing your bond returns with an "alternative" investment, what are the pros/cons of using Preferred over High Dividend Yield stocks? Or, should I just keep tapping my shoes...

I have about ~13.4% of our total in a portfolio of mostly investment grade preferred stocks that yield 5.75-6.00%. I consider this to be a subset of my fixed income portfolio which is ~67% of the total... ~53% of the total is in good yielding credit union CDs that average about 2.9% APY. So my fixed income portfolio is a bit of a barbell... heavily CDs on one side and with a small preferred stock portfolio on the other side.

I view my preferred portfolio as a higher yield fixed income portfolio... a step up from junk bonds and akin to low investment grade/higher-grade junk bonds and less volatile than high dividend stocks.

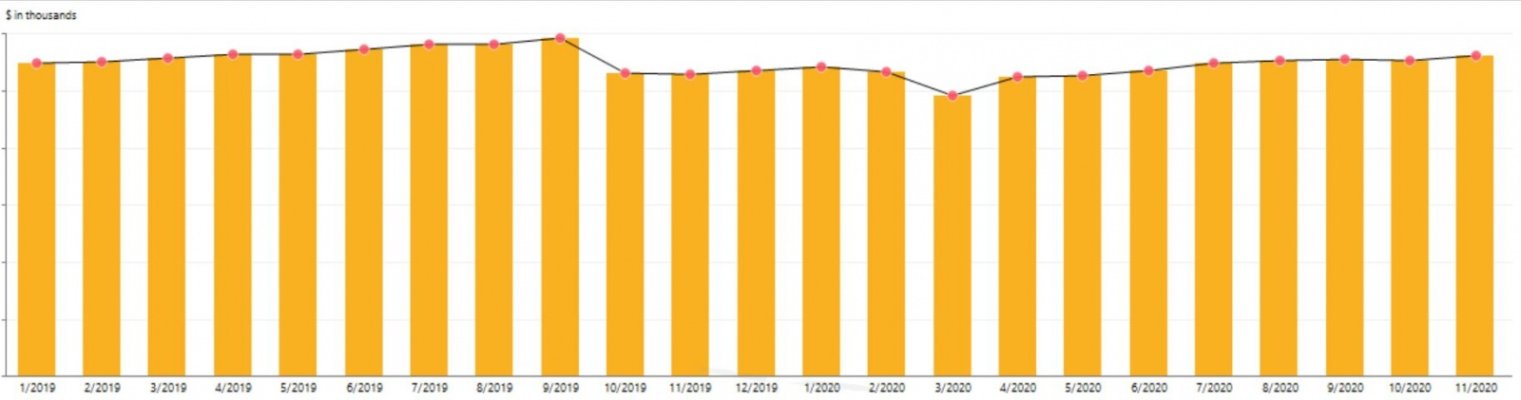

I built the portfolio in early 2019 and it has returned 8.2% annually (XIRR) since then. It did take a small ~8-9% hit in March 2020 when the SHTF but rebounded quickly.... see the dip and recovery on the right side of the graph below. (The drop in Oct 2019 was a one-time withdrawal).

By contrast, the Vanguard High Dividend Yield ETF dropped 24% from the end of January to the end of March and is still 11% off from the end of January.

| A | 4.9% |

| BBB+ | 9.4% |

| BBB | 28.5% |

| BBB- | 32.8% |

| Inv GR | 75.6% |

| BB+ | 8.9% |

| BB | 8.5% |

| NR | 6.9% |

| N-IG | 24.4% |

| Total | 100.00% |

Attachments

Last edited:

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ok, I know the argument let stocks be stocks and bonds be bonds, but I am guilty of trying to squeeze out a little extra juice in my bond allocation by owning a small portion of a preferred ETF (PGX). ...

This is a contrary opinion so here goes. I think you were right in the first sentence before the "but".

I think one should just adjust the AA to use more broad based stocks to counter the expected poorish future bond returns. So my method is to look at how it has worked in the past to add more equity versus using bond funds that have some equity like (corporate) risk. This is certainly not a new idea.

Specificly, in my 60/40 portfolio, 20% was in intermediate investment grade bonds (VFIDX). I find that I could match or beat VFIDX in the past by doing something like 4% sp500 and 16% intermediate Treasuries. So my current allocation is now 64/36 with 16% in intermediate Treasuries (VFIUX) and the rest of the bond side in TIPS and iBonds.

I count preferred’s as their own category. I use the following categories: Bonds, cash, equities, preferred, and reits. I don’t really spend any of the income from the preferreds or other dividends per se. Instead this “income” goes into cash until reinvested or spent. I’ve been doing this for about 6 years. I further break equities down into equities and options on equities (almost all of which is in index ETFs). I suspect I keep more cash, less bonds, and more preferreds than most people here. Someday I may simplify and eliminate bonds and the REIT categories. I advocate everyone uses the AA they are comfortable with and what works for them. I don’t advocate what I do for everyone else.

I live completely off my investment income.

My split:

58% Dividend Paying Individual Stocks

15% CDs

13% Individual Preferred Stocks

11% Individual Muni Bonds

4% Cash

It takes a lot of time to research individual issues but I have better luck with them vs. Funds.

My split:

58% Dividend Paying Individual Stocks

15% CDs

13% Individual Preferred Stocks

11% Individual Muni Bonds

4% Cash

It takes a lot of time to research individual issues but I have better luck with them vs. Funds.

Similar threads

- Replies

- 29

- Views

- 5K

- Replies

- 24

- Views

- 2K

- Replies

- 26

- Views

- 1K