OrcasIslandBound

Recycles dryer sheets

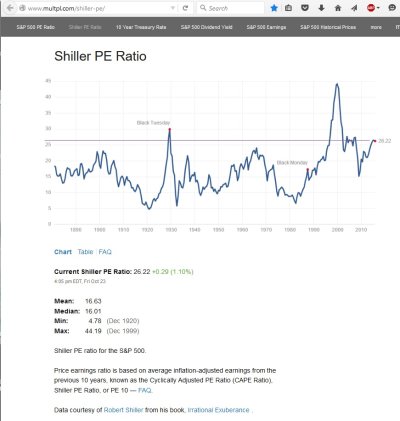

"Shiller PE ratio for the S&P 500. Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10. Data courtesy of Robert Shiller from his book, Irrational Exuberance

"

"

Shiller PE Ratio

This ratio appears to be almost peaking for a time span of the past 135 years with only the great depression, the dot-com bust and the great recession being historically greater. And the great recession was really not much greater, more like about the same.

This is one reason that our family has chosen to not go higher then 45% stocks for our AA. It seems much more likely that we will see stock market declines in the future.

But, we certainly won't go less than 45% stocks as we're not market timers and who can predict the future?

Shiller PE Ratio

This ratio appears to be almost peaking for a time span of the past 135 years with only the great depression, the dot-com bust and the great recession being historically greater. And the great recession was really not much greater, more like about the same.

This is one reason that our family has chosen to not go higher then 45% stocks for our AA. It seems much more likely that we will see stock market declines in the future.

But, we certainly won't go less than 45% stocks as we're not market timers and who can predict the future?