Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Will the stock market have a soft landing in 2023 or will it be a hard landing?

Here is what a soft landing looks like:

And here is a hard landing:

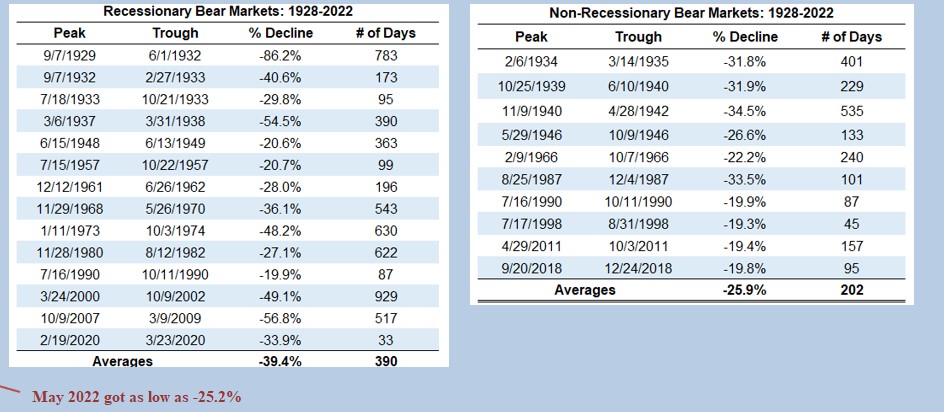

See my next response for statistics of previous bear markets.

Here is what a soft landing looks like:

And here is a hard landing:

See my next response for statistics of previous bear markets.