Too tedious to embed all the quotes, but I think anyone can follow along by looking back a few posts:

They seem to do OK, but, as you say, index funds are better! ...

Did I say that?

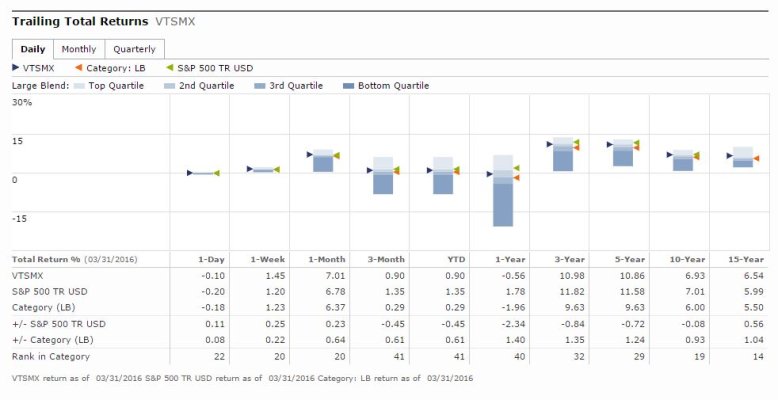

Studies show that few actively managed funds beat their indexes, and the ones mentioned by the OP appear to have failed as well. That's why I said 'why bother' with that fund.

Dunno. Minority of what? What are the numbers? What indexes would they lag? That always seems confusing. And as the Wellesley managers make changes, such as tweaks to the duration of the bond portion, do you change the indexes you'd compare to at the same time? How do you do that?

I'm sure you are familiar with the many studies that show only a minority of actively managed funds beat the indexes, and fewer still do it over longer time frames. I google it from time to time, to see if it still holds, and it always seems to.

As far as which index to compare, I look at that in a pragmatic way, rather then the technical way you are describing. I may chose to invest in X or Y. But that doesn't mean my choice Y has to attempt to duplicate every move and allocation that X does. It's just a choice, and we will see how it plays out over time.

The overwhelming majority of my equity investments are in broad based, common indexes such as TSM or S&P 500 or MSCI Developed, etc. But I'm never quite sure if I've optimized the percentages or even picked exactly the right ones. For example, do you prefer the market completion index to the mid-cap index? Or the Schwab 1000 index to the S&P 500 index? That's why I have my son's $$$ in actively managed balanced funds which target a typical AA for his age and personal situation. I don't want to make the choices for him and be responsible for timing rebalancing.

I'm never sure if I've optimized anything either, and don't worry about knowing the un-knowable. One segment (mid-cap, small-cap, etc) will do better here and there, but who knows going forward? Over time, things seem to even out. I'm happy (maybe even dumb and happy?) with a loose AA based mostly on SPY and a Total Bond Index fund.

I don't follow your 'broad brush' comments in other posts. If we are talking about active versus passive funds in general, well that

is a broad brush view, no bones about it. Then there was the specific American Fund - not broad brush, a comparison to SPY, as an example.

Vanguard's Wellesley and Wellington specifically have done amazingly well over the long run. I'm puzzled by that - if it was knowledge based, why isn't it repeated by more active funds? Do they really have the 'secret sauce'? Can it be taught to the next managers (seems so, they've been on a long run)?

PerfCharts - StockCharts.com - Free Charts

Slide the bar to the full 15 years, and Wellesley is impressive.

-ERD50