davismills

Recycles dryer sheets

- Joined

- Dec 6, 2012

- Messages

- 335

The Feds policy reminds me of the old Air Force saying. "Measure it with a micrometer, mark it with a pencil and cut it with an ax"

Concerning your higher mortgage rate thoughts. I just rolled into a 2.75% 15 yr. with no intentions of leaving. But I wonder in say 5-10 years (if mortgages stay at this level or higher) when people want to “move up” or “on” will these people with the same low mortgages get “trapped” in their present house?

Unwilling to give up a sub 3% note for a 5.5% or 6%? It sure would make me think twice.

If hedge funds have been buying up residential real estate then perhaps they will have to unload it. This might be a good thing.

You’re right that it would be a good thing. I fear it will not happen, or at least they will dump other assets first, because residential real estate generates cash flow, and they first will be exiting investments that generate no cash.

Here's another issue I have with the Dimon quote: What does he mean by "hurricane"? It's a term that could mean any sort of moderately bad thing...is it really high inflation? Job layoffs? GDP contraction? Bitcoin failing? More supply chain issues? It could be any of those or any number of other things, of any moderately bad degree for any duration of time sometime in the near future.

Let's face it - Dimon nor anyone else knows exactly what's gonna happen. He just believes its gonna be "bad." How bad? He doesn't know .......

I was reading portions of this news article about Jamie Dimon to my husband and then laughed out loud when I saw this headline in the next article:

"Elon Musk has 'super bad feeling' about economy...." Um.... Super Bad? !!

Of course, then next headline read something to the effect of "Bear Market Bottom reached, markets heading back up"

Yes, Elon Musk is feeling "Super Bad" enough to shed 10% of his work force. I think that counts as "super bad"

The tweet I read said salaried only. Explicitly mentioned was the people on production weren't being cut.I thought it was just 10% of the "salaried" work force, but some sources haven't mentioned that.

The most terrifying of all is that Jim Cramer tweeted yesterday that we won’t have a recession. Twitter reacted that his statement means one is guaranteed, LOL.

This affects the equities market. a how does it affect the goods and services producing economy? Real businesses that generate profit and cash are not threatened by an increase in rates.Tech has been dragging the rest of the S&P up for years but now tech has nosedived.

Is the US economy addicted to easy money? Does this easy money benefit the producers of goods and services, or does it benefit the investment community?However, though Central bank tightening is underway rate hikes can only be modest and symbolic, compared to inflation, without causing a recession, since the economy is addicted to easy money.

The US is a net exporter of petroleum products, wheat and most other agricultural commodities. Russian commode export disruptions jeopardize other parts of the world, but much less so the U.S.Oil, wheat, nickel and more commodities are threatened by the shooting war in Europe.

But not a manufacturer of high value capital goods, exceptions being perhaps to solar products.Parts of the world’s manufacturing center, China, has been locked down.

But it is much less dangerous for vaccinated people.Covid is not done with us.

Can’t argue against that …The most terrifying of all is that Jim Cramer tweeted yesterday that we won’t have a recession. Twitter reacted that his statement means one is guaranteed, LOL.

Let's face it - Dimon nor anyone else knows exactly what's gonna happen. He just believes its gonna be "bad." How bad? He doesn't know - just like you don't know how bad a hurricane is gonna be. You just know it's gonna be worse than "business as usual." He could have used any number of other more or less nebulous terms: Train wreck. S/// show. Cluster Flop. Etc.

I just watched Dimon explain what HE meant by a hurricane. It's like when a hurricane's coming and you don't know it. The weather might be bright and sunny, you go to the beach, you don't know to take cover and then the hurricane hits. It takes you by surprise. So jobs are good. The economy is still reasonably strong. People have savings. But what's it gonna be like in 6 months. Don't know, but I'm betting its gonna be worse. Dimon think it's gonna be "bad." How else should he say it than hurricane? He doesn't know what the inflation rate will be. He (nor anyone else) knows what unemployment will be. He (nor anyone else) knows what the stock market is going to be doing.

SO, yeah, "hurricane" isn't precise - but then again, there's no way to predict a hurricane and that's what he's suggesting about the economy.

Do you have a better term that covers the concept of "now it's good but soon it won't be" in terms of the economy. I don't know a financial term that one would use that describes the uncertainty of the outcome but the near certainty (in Dimon's mind) that it's coming. YMMV

Inflation is *reportedly* 8+%. So far they have raised the FFR 0.75% in the last year and are looking at a couple of 0.5% raises in the following months. Yes, they are doing something and I am sure it will be painful going forward, like a slow roasting on a spit.

Wait until mortgage interest rates go much higher and see the screaming that will happen when the inflated house prices start dropping like apples off a tree. That's what these politicians are scared of.......a quick drop in asset prices that will surely come with higher interest rates.

I don't think the politicians care about the stock and bond markets (they probably already went to cash - re. two FED governors quietly resigned over their insider trading last few months).

I read the federal funds rate is now .75 - 1%, last CPI numbers were 6.3%. It will be interesting to see if the last lower CPI numbers were the start of a trend or just a blip. At least one fed member said 2.5% by the end of year would be "prudent". The rate changes so far have already cause a pretty big increase in mortgage rates and a drop in home sales.

Real businesses that generate profit and cash are not threatened by an increase in rates.

...

Is the US economy addicted to easy money? Does this easy money benefit the producers of goods and services, or does it benefit the investment community?

Aside from Cramer, a long list of things that will impact the US economy, but there’s no reason to think it will lead to a recession. They will, however, cause some inflated risk assets to lose value. How is that bad for us?

snip

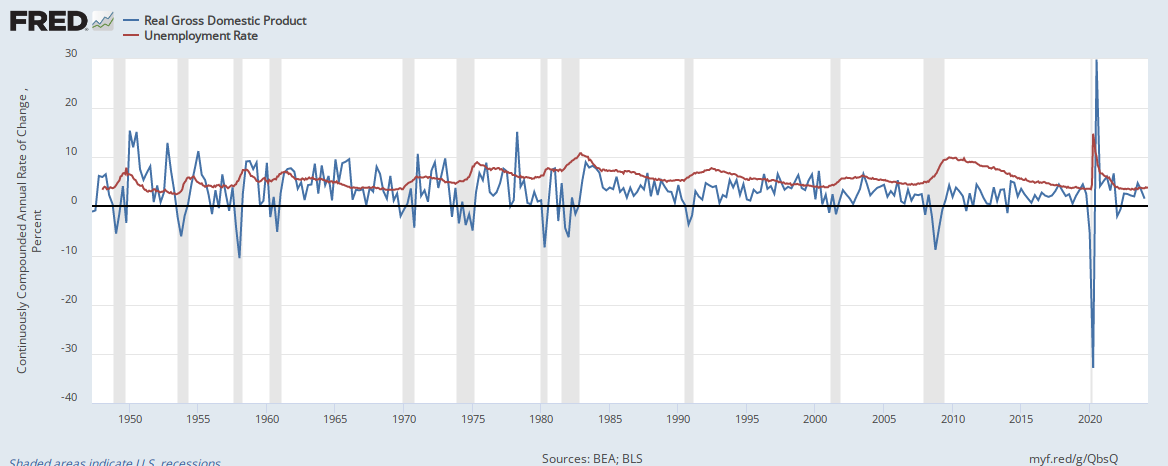

Finally, Q1 GDP was a surprise negative print. If the Q2 GDP growth is negative, we will officially be in a recession.

I just finished watching a documentary (free with Prime) called The Flaw about the housing market crash.

One of the messages I came away with was that the real root cause was income inequality. If this was a big factor then I think we are still in trouble.

One source I looked up recently claims currently in the US the bottom 90% of families own less than one-quarter of all wealth.

I've attached a screenshot from the documentary showing income distribution in the US from 1920 to 2007.

If you're actually asking, I think if he is sincere about making predictions, then he should make literal, specific predictions that are testable and actionable. Some random examples:

1. "I think unemployment is going to hit double digits in the fall" might affect someone's job search or job activities

2. "I think the S&P will be under 3500 at year end" might affect someone's investment decisions

3. "I think mortgage rates will be 7% for 30 year fixed products by September" might affect someone's mortgage-related decisions

I'll be blunt: I doubt that his predictions are altruistic; I think they are self-serving somehow. I also doubt (as it seems you do) that his predictions are going to be accurate or useful. I think he is being intentionally vague so that either (a) he has a better chance of being able to claim he was right when some bad thing happens sometime, or (b) he can reasonably assert a defense for anyone who might choose to rely on his "prediction" (or both).

Hurricanes rarely take anyone by surprise anymore, so if that's part of his metaphor it's pretty lousy. Also I would be shocked if any of the regulars on this board would be surprised by something bad happening soon in the US economy.

That seems like a stretch to blame the housing crash during the great recession on income inequality. It was banks doing stupid things.

Income inequality will fix itself. Always does. Sometimes it requires a revolution, sometimes just a depression. France went with a revolution. We went with a depression.

Redistributing wealth via legislation is socialist/communist which is fine if that's what we want our economy to be based on.

That seems like a stretch to blame the housing crash during the great recession on income inequality. It was banks doing stupid things.

That seems like a stretch to blame the housing crash during the great recession on income inequality. It was banks doing stupid things.

Income inequality will fix itself. Always does. Sometimes it requires a revolution, sometimes just a depression. France went with a revolution. We went with a depression.

Redistributing wealth via legislation is socialist/communist which is fine if that's what we want our economy to be based on.

I submit it was regulators (at the behest of politicians) relaxing reasonable restriction of banks offering loans. Anyone recall no-doc loans and bundling of toxic debt as A rated bonds? What could possibly go wrong?

Aside from Cramer, a long list of things that will impact the US economy, but there’s no reason to think it will lead to a recession. They will, however, cause some inflated risk assets to lose value. How is that bad for us?