easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,152

Stock and Fund Investors, show us your stuff ...

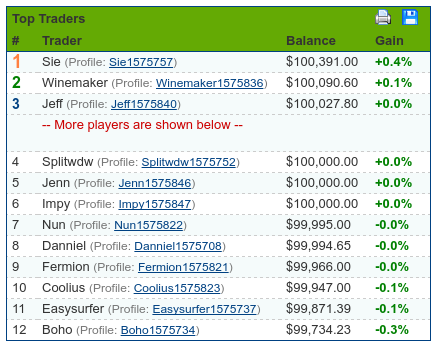

This is the thread for the "Beat Boho" stock picking contest. Click on the leader board link to sign up, see contest details and see who is up or down throughout the contest.

Leader Board: Stock Contest Status for "Beat Boho"

Last day to join is April 10, 2017.

Contest ends March 11, 2018.

Have fun participating and watching!

Note: Only virtual dollars used. Nothing on the line except your ego and bragging rights .

.

This is the thread for the "Beat Boho" stock picking contest. Click on the leader board link to sign up, see contest details and see who is up or down throughout the contest.

Leader Board: Stock Contest Status for "Beat Boho"

Last day to join is April 10, 2017.

Contest ends March 11, 2018.

Have fun participating and watching!

Note: Only virtual dollars used. Nothing on the line except your ego and bragging rights

Last edited:

Ummm, holding back might be a strategy in a foot/car/horse race, but I fail to see how it can help a portfolio. Less to leverage later. But we shall see.

Ummm, holding back might be a strategy in a foot/car/horse race, but I fail to see how it can help a portfolio. Less to leverage later. But we shall see.