Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

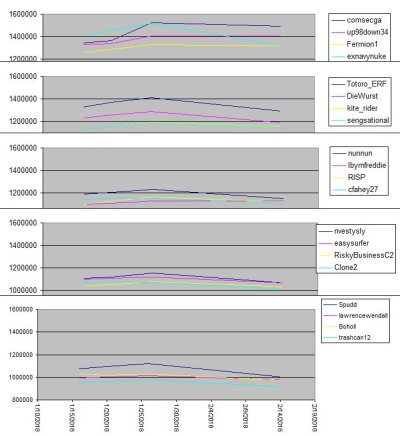

And yet, with this knowledge, you still dragged behind the market benchmark, with a 2.70% gain versus 5.33% for the market.

Just wait until you see next month's numbers. I dropped significantly today and I could easily see the SEC make the drop worse.

I'd personally cyber-hand the winner the prize. The rules are the rules. What I'd take from the results if I lost may be more than realization that "I lost" but you can take as little as you choose.