Looking4Ward

Full time employment: Posting here.

With a majority of my portfolio in Vanguard Wellington, I've been pleased with it's performance over the last 8 years that I've been FIRE'd.

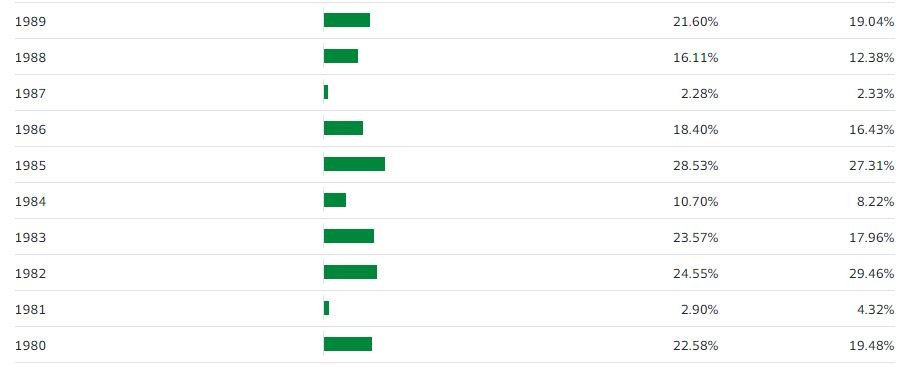

Looking forward, I'm curious how Wellington may do during periods of high inflation and rising rates like we are currently experiencing. We haven't seen conditions like these since the early '80s, so I looked back at how Wellington performed for that decade and the past results seem to indicate it did very well (chart attached).

Would it be unreasonable to think that Wellington has the potential to again fare well during similar economic conditions?

Looking forward, I'm curious how Wellington may do during periods of high inflation and rising rates like we are currently experiencing. We haven't seen conditions like these since the early '80s, so I looked back at how Wellington performed for that decade and the past results seem to indicate it did very well (chart attached).

Would it be unreasonable to think that Wellington has the potential to again fare well during similar economic conditions?