We would immediately start giving it to our children plus 1 off cash gifts to our siblings (all our parents' generation are dead). We can each give $15k per person without tax implications so we could give away $60k/year to our 2 children. ($30k each)

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What would you do with $1 million in cash

- Thread starter djr59

- Start date

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

This premise would make a great TV show.

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

This premise would make a great TV show.

+1

I wonder if John Beresford Tipton Jr.'s heirs would be interested in funding a pilot?

Bestwifeever

Moderator Emeritus

- Joined

- Sep 17, 2007

- Messages

- 17,774

I observed that he asked in the forum "Stock Picking and Market Strategy".

If he asked in the "Life after FIRE" forum, then his intention might be more about indulgences.

Some of us noticed that (http://www.early-retirement.org/for...th-1-million-in-cash-84702-3.html#post1816913)

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Yes, many did notice that the question was about investment choices.Some of us noticed that (http://www.early-retirement.org/for...th-1-million-in-cash-84702-3.html#post1816913)

Quite a few were so ready to spend it though, or to use, ahem, "alternative" investment ideas.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

This premise would make a great TV show.

+1

I wonder if John Beresford Tipton Jr.'s heirs would be interested in funding a pilot?

I missed the rerun of "The Millionaire" series, and never watched a single episode. To be fun, it should have plenty of unintended consequences. For example, a person buys a beach-front property only to have it flattened by a hurricane. Or he buys a fancy diesel-pusher class A motorhome to get stuck on a remote Alaskan highway, with equipment malfunctioning, in a storm and with grizzlies circling, etc...

But I guess the original series might have exploited all these ideas already.

It was the subject of a film made in 1932 If I Had a Million (1932) - IMDbThis premise would make a great TV show.

W C Fields starred in one of the segments, very funny, titled "Road Hog" about one man using his windfall to buy a fleet of cars and use them to run bad drivers off the road.A dying tycoon gives million-dollar windfalls to eight people picked from the city directory.

exnavynuke

Thinks s/he gets paid by the post

Step 1 - Put in my two week notice.

Step 2 - Pay off remaining mortgage balance (~$125k).

Step 3 - Invest $700k in my brokerage account.

Step 4 - Max out IRA contribution for next year.

Step 5 - Give my brother $100k for a down-payment on the house he finds to buy.

Step 6 - Buy a new(er) car ~$20k plus trade-in value.

Step 7 - Use the remainder as my 2017 spending money.

Step 2 - Pay off remaining mortgage balance (~$125k).

Step 3 - Invest $700k in my brokerage account.

Step 4 - Max out IRA contribution for next year.

Step 5 - Give my brother $100k for a down-payment on the house he finds to buy.

Step 6 - Buy a new(er) car ~$20k plus trade-in value.

Step 7 - Use the remainder as my 2017 spending money.

We can each give $15k per person without tax implications so we could give away $60k/year to our 2 children. ($30k each)

The annual gift tax exclusion for 2017 is still at $14k per person, according to the web.

Andre1969

Thinks s/he gets paid by the post

If this was $1M, tax free, in addition to what I already have, I'd buy my "early retirement" home, and then, once that's secured, go ahead and retire.

Only reason I'd want the home in place first, is that I imagine it's easier to get a mortgage while I still have a j*b. Or, even if I could get a mortgage while retired, they might want a bigger down payment, and I'd rather have the assets working for me, compounding, rather than tied up in home equity.

I imagine that my final time at w*rk would be difficult, though. Even now, I'm having problems coming in to the office. I imagine that once I know I really don't have to, I'll be itching to get out of here.

Only reason I'd want the home in place first, is that I imagine it's easier to get a mortgage while I still have a j*b. Or, even if I could get a mortgage while retired, they might want a bigger down payment, and I'd rather have the assets working for me, compounding, rather than tied up in home equity.

I imagine that my final time at w*rk would be difficult, though. Even now, I'm having problems coming in to the office. I imagine that once I know I really don't have to, I'll be itching to get out of here.

ShokWaveRider

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I would Wake Up! or..... Keep it to pay for health care after ACA.

Pilot2013

Full time employment: Posting here.

Bryan Barnfellow

Thinks s/he gets paid by the post

1. Send it to Washington to help pay down the national debt!

2. Come out of retirement and begin a new career as a stand up comedian.

-BB

2. Come out of retirement and begin a new career as a stand up comedian.

-BB

If I suddenly received one megabuck totally out of the blue, I know what I would really like to do with it.

Quietly, unobtrusively, I would leave a $100 bill as a tip everywhere I went to eat. Also any other places where a cash tip would be appropriate. I could do that 10,000 times, so really for the rest of my life. I think it would be great fun and a very good use of the dough.

Actually, I often do that now, but generally with a $10 bill where it wouldn't be expected. I'm sure it makes someone's day and it certainly gives me a good feeling.

Quietly, unobtrusively, I would leave a $100 bill as a tip everywhere I went to eat. Also any other places where a cash tip would be appropriate. I could do that 10,000 times, so really for the rest of my life. I think it would be great fun and a very good use of the dough.

Actually, I often do that now, but generally with a $10 bill where it wouldn't be expected. I'm sure it makes someone's day and it certainly gives me a good feeling.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

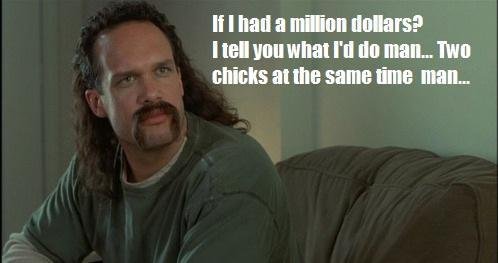

My favorite...

You don't need $1 million to do that! A friend of mine has the nickname "Lucky" for good reason.

- Joined

- Oct 13, 2010

- Messages

- 10,761

I wrote the "splurge" comment without knowing what forum it was in.I didn't even notice what forum it was in, because I was looking at the portal view.

It seems like most posters here have their finances in balance, and are happy with that balance (or at least claim to be happy with that balance). So, logically, adding another "$35K/yr" shouldn't be required. Thus, doing something "stupid" seemed justified. By "stupid", I mean something you simply could not do without the windfall. My choice (buying a big boat) probably has something to do with my not being able to spend a dime any more without tax consequences.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This premise would make a great TV show.

I remember it well.

https://en.wikipedia.org/wiki/The_Millionaire_(TV_series)

Been looking for the symbol for this hookers investment you mention - can't find it. Considering your track record it must be a good one! please shareSpend half on hookers and blow, $100,000 to a mix of charities, then waste the rest on half stocks and half bonds. I'd like to up my bond holdings a bit.

NW-Bound keeps insisting that I must buy the Focal Grande Utopia EM Speaker at about $200k or so (it varies), so to go along with that theme, I must get the Onedof Turntable ($150k) Onedof turntable spins your vinyl for a cool $150,000. I have actually listened to this turntable and must say it is sublime - brought tears to my eyes. But we still need an amplifier let's see, the Pivetta Opera will do ($500k) (haven't heard this one but sounds impressive) but this purchase might leave us a bit shortchanged for preamps,speaker cables, interconnects and such. I mean, $150K for cables and other ancilliaries is really cutting it close no? The horror of not having sufficient funds!I would carefully invest 90% of that in fast cars, sloe gin and wild women. The rest I'd waste by plowing it back into my portfolio.

fern

Dryer sheet aficionado

I'd quite my job search and relish in my newfound freedom. I'd get a new kitchen and central AC here.

The annual gift tax exclusion for 2017 is still at $14k per person, according to the web.

PLUS $5.45m during life or at death so a mere million does not cause any gift tax implications if you want to give someone $25k or $50k or whatever....

FiveDriver

Full time employment: Posting here.

Been looking for the symbol for this hookers investment you mention - can't find it. Considering your track record it must be a good one! please share

The Ticker symbol is HO, and you'll probably find it on the Pink Sheets.

Bada - Boom.

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,451

The annual gift tax exclusion for 2017 is still at $14k per person, according to the web.

AFAIK the <$14K only means that you don't have to report it to the IRS. Over that amount and you report it but don't pay tax until you've gifted over $5M. (I think it's $5M)

I think you can give out <$14K to 1000 different people and not even have to report it.

To the kids... via an elder law attorney.This could be interesting.

If you suddenly found yourself with a million of cash that was not invested in bonds or stocks, what would you do with it given the current stock/bond market.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Well, for someone who already has everything else, why not?NW-Bound keeps insisting that I must buy the Focal Grande Utopia EM Speaker at about $200k or so (it varies), so to go along with that theme, I must get the Onedof Turntable ($150k) Onedof turntable spins your vinyl for a cool $150,000. I have actually listened to this turntable and must say it is sublime - brought tears to my eyes. But we still need an amplifier let's see, the Pivetta Opera will do ($500k) (haven't heard this one but sounds impressive) but this purchase might leave us a bit shortchanged for preamps,speaker cables, interconnects and such. I mean, $150K for cables and other ancilliaries is really cutting it close no? The horror of not having sufficient funds!

I do not spend money on something that I would have to put its value on my Quicken screen. Currently, I have only investable accounts on Quicken, and my home values are not entered in. I guess I would add this Hi-Fi equipment if I bought them convinced that they are investable and not consumable.

Last edited:

Similar threads

- Replies

- 4

- Views

- 628

- Replies

- 22

- Views

- 1K

- Replies

- 19

- Views

- 533

- Replies

- 51

- Views

- 5K