target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I consider this page every now and then:Another option for those concerned about lofty equity levels is to shift toward more conservative stocks such as utilities. A utility-heavy portfolio barely noticed the 2008/2009 rout. As a sector, Utilities are up only 1.7% during the past 3 months, while by comparison Transports are up over 20%.

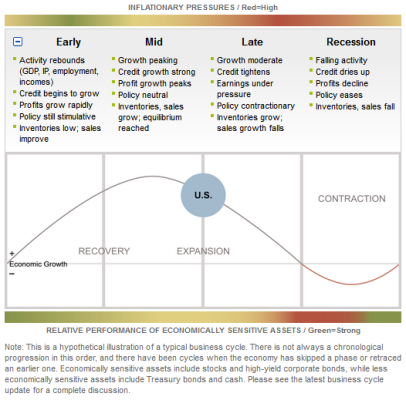

https://eresearch.fidelity.com/eres...ectors/si_business_cycle.jhtml?tab=sibusiness

During a recession the four sectors Utilities, Telcom, Healthcare, Consumer Staples (VPU VOX VHT VDC) are said to perform better. However, expect them to drop as well. One or two large companies in Telcom, for example, might perform better.