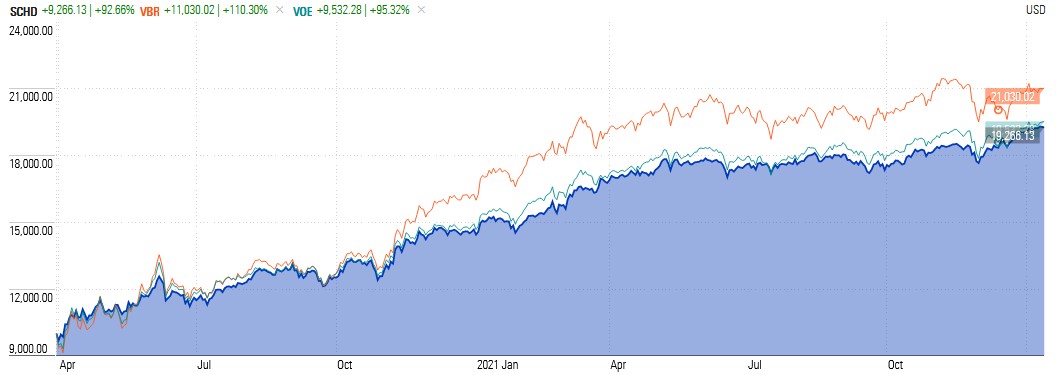

My is SCHD

Because it contains collection of wide moat high quality dividend growers.

It is a gem index ETF.

It is not my biggest holding, but it is biggest narrow based ETF holding I have.

Value oriented and stark contrast to my favorite stock which is NVDA . By narrow mean

. By narrow mean

ETF with less than 250 holdings so don't write that your is S&P 500 please.

Because it contains collection of wide moat high quality dividend growers.

It is a gem index ETF.

It is not my biggest holding, but it is biggest narrow based ETF holding I have.

Value oriented and stark contrast to my favorite stock which is NVDA

ETF with less than 250 holdings so don't write that your is S&P 500 please.

Last edited: