Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

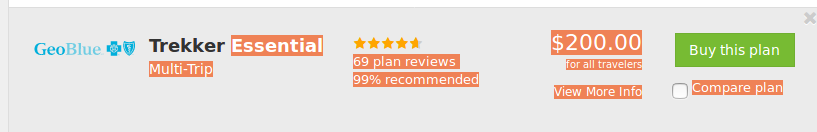

I have been looking at medical insurance options when I travel.

From what I read, if one has coverage from one of the "Blues" - Blue Cross or Blue Shield - and your policy provides for travel coverage - one is in good shape and does not need to buy additional coverage for travel in most 1st world countries.

https://bcbsglobalcore.com/Account/Login?ReturnUrl=/

BlueCard Worldwide has a list of hospitals and doctors that contract with the Blue insurance companies. Just pick one of them and you have coverage.

Has anybody ever actually used this service? It seems reasonable on the surface and would be far less expensive than buying travel insurance to cover medical costs. The only gap would be medical evacuation insurance, and that can be covered with a separate and cheaper policy.

From what I read, if one has coverage from one of the "Blues" - Blue Cross or Blue Shield - and your policy provides for travel coverage - one is in good shape and does not need to buy additional coverage for travel in most 1st world countries.

https://bcbsglobalcore.com/Account/Login?ReturnUrl=/

BlueCard Worldwide has a list of hospitals and doctors that contract with the Blue insurance companies. Just pick one of them and you have coverage.

Has anybody ever actually used this service? It seems reasonable on the surface and would be far less expensive than buying travel insurance to cover medical costs. The only gap would be medical evacuation insurance, and that can be covered with a separate and cheaper policy.