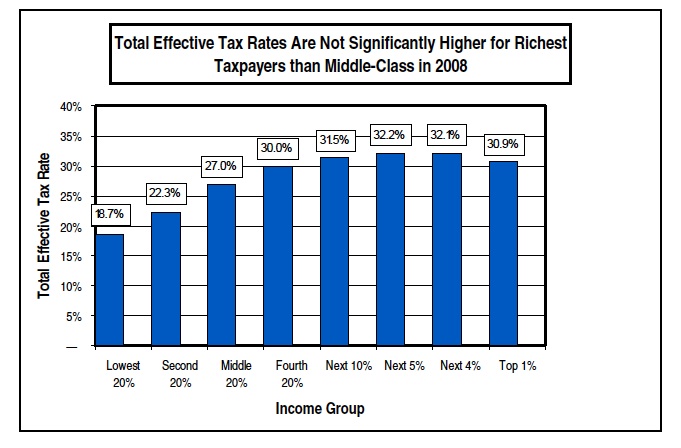

I believe we will have to increase taxes and reduce spending. But I'd argue that our marginal rates are progressive enough, and we ALL need to pony up with higher rates at all levels. What I disagree with is the let's just tax the rich more, when they already pay more than their share, and especially those who don't even bother to look at the data. That's simple class warfare, as if "the rich" are rich for no other reason than dumb luck.

And the post that said 'I'd be willing to pay more for more/better services' has clearly not bothered to look at our revenues, spending and deficits. We won't come meaningfully closer to balanced budgets until the electorate accepts significant changes in Soc Sec, Medicare, defense and revenues/taxes (individual and Corp BOTH). There are undoubtedly reductions possible in non-discretionary/non-defense spending, but nowhere near enough there alone.