ERD50 said:

What I really fear is, this might take some form of Net Worth measurement to determine who is 'wealthy' (as alluded to in your post).

The specific fear is that someone with $1M portfolio will be looked at as 'wealthy', while someone with a $40,000 COLA pension and nothing in the bank will be looked at as 'poor'. And taxed accordingly.

-ERD50

Sure that

could happen, but it won't. We, the wealthy, have far more political power than the poor. It hasn't happened in 200 years and it won't happen in the next 200 years. Raising taxes to 1993 levels is hardly violent wresting of your hard earned money. Hyperbole doesn't really move the conversation forward. Gatordoc believes that there is a level of taxation that suppresses effort. I absolutely agree with him, but there is also a level of taxation that is so low that a country can not invest in it's citizens. There's a big gap between those extremes and within that gap it appears from empirical data that taxation levels have little effect on productivity. Right now we have a level of federal taxation that has not been seen since the 50s -- before Medicare, the interstate highway system, NASA, large investments in secondary education, etc. If we let taxes rise to the levels that we had under Johnson, Nixon, Reagan, or Clinton, I doubt that we would suppress growth. The idea that the American "left" is anything other than center-right may help the other side win elections, but it's just not an accurate picture. I'm an ex-engineer and I tend to be pretty pedantic, so you will forgive me, but data is important to me.

Third world countries often have levels of taxation that are inadequate to build the necessary infrastructure to thrive. One of Colombia's tools for getting their violence problem under control has been higher taxes on the wealthiest citizens. A certain peripatetic former American president was enlisted to convince the upper crust that paying a bit more in taxes was in their best interest. Charming old rogue that he is, he succeeded and Colombia is much more stable as a result.

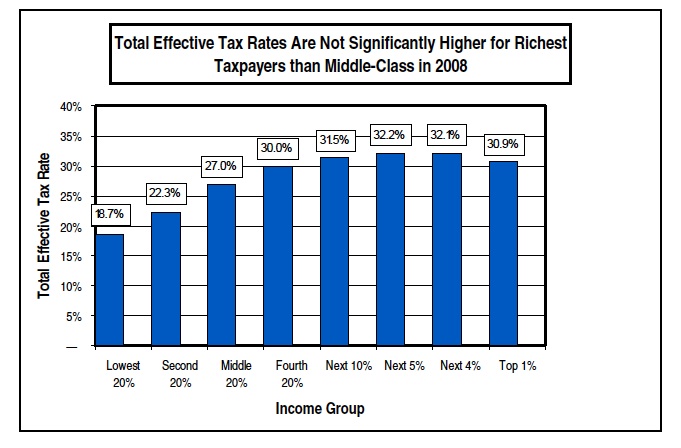

The chart I posted was from Citizens for Tax Justice. It's based on 2010 tax data.

I get sent to moderation when I post links, but James Fallows and others had a relevant charts about the sources of the current deficit and debt drawn from.CBO data. You can see them in the July 25th blog postings. The problem really is those damn wars and the Bush tax cuts, Medicare part D didn't help, either.