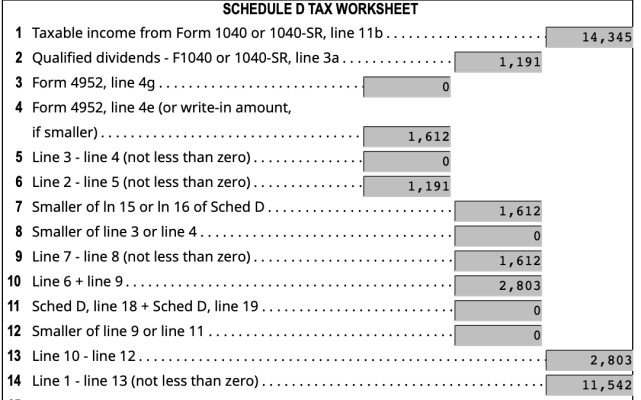

I use H&R Block software to figure my taxes for 2019 and wanted to investigate how my taxes were calculated. The software uses 1040 form and on line 11b for taxable income is $14,345. The next entry with data on the form shows at line 12a a tax of $1153.

I am using married filing jointly and the tax tables show any amount below 19400 the tax is 10%. Anyone know why the form would only show 1153 owed instead of 1434?

I am using married filing jointly and the tax tables show any amount below 19400 the tax is 10%. Anyone know why the form would only show 1153 owed instead of 1434?