target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The situation is that I am helping someone with US tax filing. The individual has only foreign income, and that is entered properly, with foreign tax properly credited.

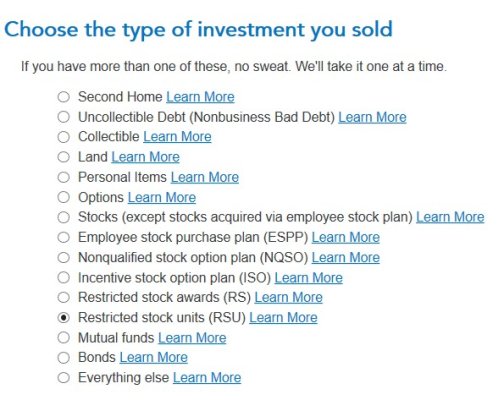

The next question is how to enter RSUs (Restricted Stock Units) which vested in 2019, but are not included on a W-2, since the foreign employer does not issue one.

The RSU lots are listed on a Solium statement, and I can see the value in USD. The shares and other information are included, but it is not clear at this time where to enter the information in TurboTax.

Is anyone familiar with handling RSUs not on a W-2 or 1099? I am thinking 1) these are ordinary income, and 2) the vesting price becomes the cost basis.

The next question is how to enter RSUs (Restricted Stock Units) which vested in 2019, but are not included on a W-2, since the foreign employer does not issue one.

The RSU lots are listed on a Solium statement, and I can see the value in USD. The shares and other information are included, but it is not clear at this time where to enter the information in TurboTax.

Is anyone familiar with handling RSUs not on a W-2 or 1099? I am thinking 1) these are ordinary income, and 2) the vesting price becomes the cost basis.