chassis, opensocialsecurity.com can provide answers.

For example, a female born 1/1/1960 with a $1,000 PIA. 2% real discount rate and 2017 Non-smoker Preferred mortality.... expected present values:

Claim at 61 & 1 month: $155,479..... 90.9%

Claim at FRA of 67: $167,257..... 97.8%

Optimal (69 & 6 mos) $171,089... 100.0%

As late as possible..70 $170,871..... 99.9%

Obviously, if PIA is $2,500 then multiply above numbers by 2.5 but %s will not change.

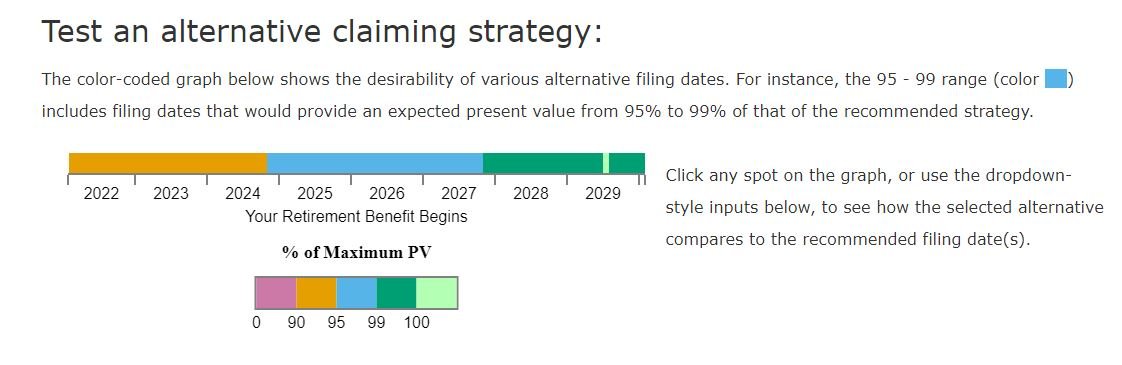

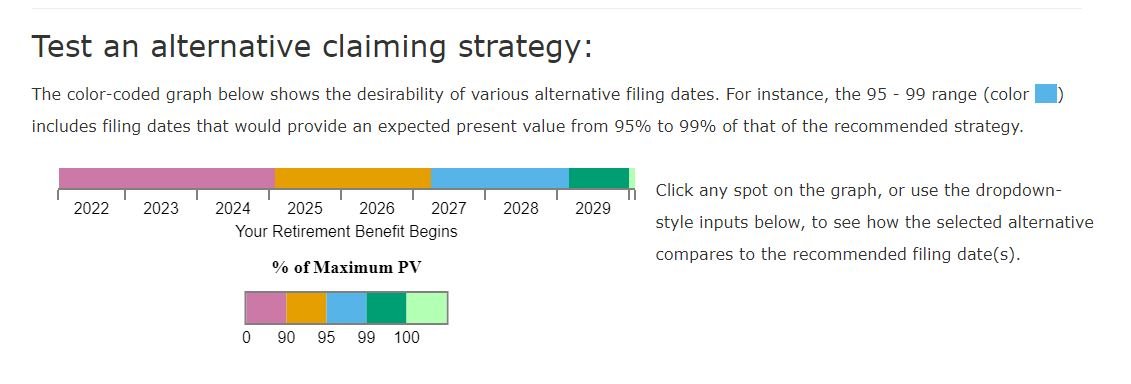

Below are two graphs... the top is with 2% discount rate and the bottom is with 0% discount rate.

How to read the graphs:

- At 2% discount rate: Mid-to-late 2029 is the sweet spot but anytime between late 2027 and age to are good. Earlier than late 2027 is increasingly suboptimal.

- At 0% discount rate: Best to take near age 70 in 2029; before that is increasingly suboptimal.