daylatedollarshort

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 19, 2013

- Messages

- 9,358

I will respond to these since they are the important ones to me...

If you are living off of TIPs... and do a ladder... (and I might be wrong on this)... but are you not SURE of running out of moneyIOW, you have your bond mature and use that money to live... next year you do the same... when your last bond pays up, you are done.... to me that is a bigger risk I am not willing to take...

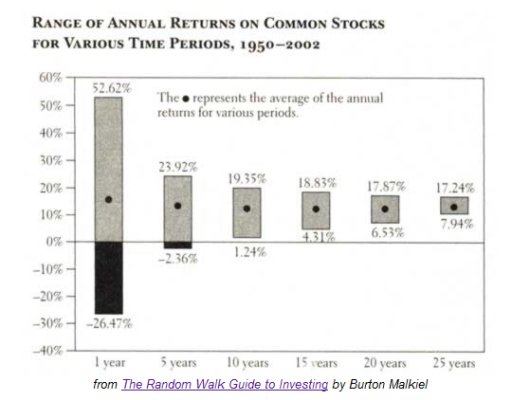

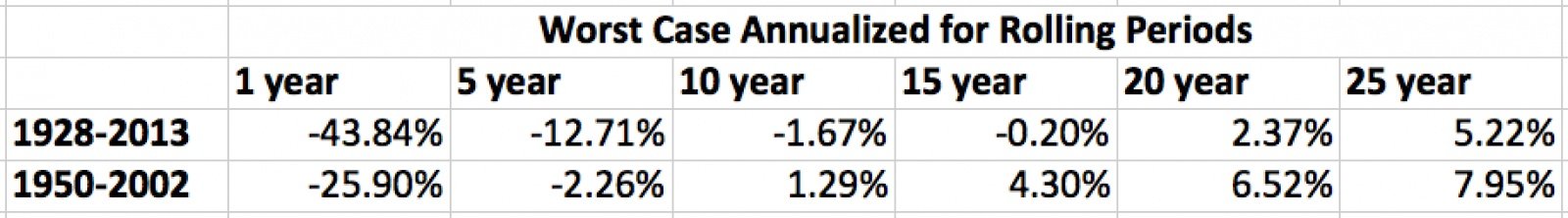

Yes, the sequence of returns is a risk.... but history seems to show that the risk is a lot smaller than most people make it out to be.... so far in my life I have been through 3 major downturns, with the 2008/09 being considered the second worst in recent history.... my portfolio is doing just fine... now, I am not retired yet, but the results of these 3 major downturns seem to show that stocks have some big time short term risks, but not long term risks.... as long as you account for those short terms, the long term should take care of itself....

For the most part we would probably buy new TIPS as the oldest mature so we'd get a rolling average of rates. We have pensions, two SS checks (future), we each have hobby jobs and a relatively modest lifestyle so we still plan to save money in retirement, and will try not to spend down the portfolio. If all goes according to my spreadsheet and Fidelity's RIP we should have a larger portfolio in inflation adjusted dollars when we are 100 than we do now. For us, I just don't see the need to take any risks with equities but maybe I am missing something.

Last edited: