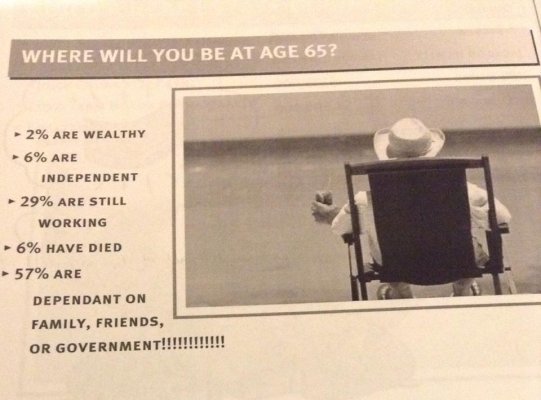

I took a real estate class in December and one of the first slides brought up was a statistics showing the number of people at 65.

When I looked at it, I estimate only 8% can really retire.

The others are still working, passed away, rely on the government or family/friends.

I added an attachment and hope it shows up.

Do you agree?

When I looked at it, I estimate only 8% can really retire.

The others are still working, passed away, rely on the government or family/friends.

I added an attachment and hope it shows up.

Do you agree?

The way the slide is worded, makes it sound like these "dependents" have somehow failed. That implies everyone who collects in the following categories, is a failure. The only "failure" was the presenter, who neglected the cardinal rule of public speaking: CYA, or Consider Your Audience.

The way the slide is worded, makes it sound like these "dependents" have somehow failed. That implies everyone who collects in the following categories, is a failure. The only "failure" was the presenter, who neglected the cardinal rule of public speaking: CYA, or Consider Your Audience.