OrcasIslandBound

Recycles dryer sheets

Hello, we are Orcas Island bound in the state of Washington. We hope to retire in April of 2017.

The stats:

Today 1.83M total, invested in 44/33/19/4 % stocks, intermediate bonds, long bonds, short term cash equiv.

Of the 1.83M about 530K is in "private money inheritance" belonging to DW. We'll be using only dividends from this portion. About 2/3 of the 1.83M is in pretax accounts the rest post tax. However, despite the sizeable post tax amount, we'll be living on mostly taxable withdrawals + taxable dividends with only a few thousand of income that won't count against ACA MAGI numbers. So, it will be a bit tricky to stay under the $63K max 400% fed poverty level for 2 people.

We're both 57 and have 1 teenager in junior college going to school about 3/4 time. This actually presents another challenge as he is not full time and therefore will not be a dependent on our taxes starting this year going forward. (There are reasons why he isn't full time, the good news is he has a part time job and is learning the meaning of saving and paying for his own expenses, car repairs, etc.)

We expect income of $47K/year for both of us from SS at age 65. I'll get a small non-cola pension of $6K/year when we retire at the age of 59 and a couple months.

Firecalc, Fidelity and Vanguard simulations all show 100% chance of success with income of $90K and firing one year earlier in April of 2016. However, to be conservative, we'll hold off until 2017.

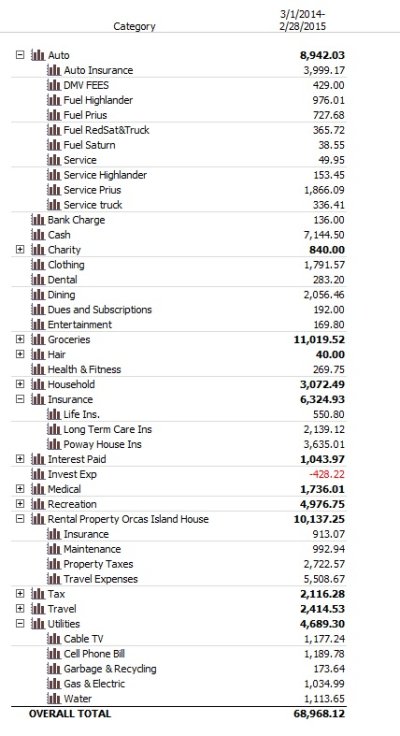

We have monitored our expenses for years and they are not low enough yet. We're at $69K/year + taxes + medical ins. We have a ways to go down further to hit $63K including taxes and ins. (Really, $63K is like $51K + $6K taxes, WA has no state inc tax, plan on being there + $6K/year ACA payments).

We have two houses, one here in SoCal, worth about $450K, no mortgage, and our intended retirement house in WA worth about $420K, $200K mortgage.

We're creating a chunk of after tax money that will be used to pay the retirement house mortgage payments + college expense for the DS. This money, about $113K, won’t count against ACA income limits and will be used up when we hit 65.

The DW is worried that, being from So Cal, we’ll be miserable in the winter months in Orcas Island. So… we’ll be traveling back and forth, like snow birds, between the two houses.

I think we can use the Orcas house as a VRBO to make extra money during the summer if we have to as this island appears to be a popular vacation spot.

We are also creating a home equity line of credit that we can draw against until we are 67 years old solely for the purpose of having a way to generate sizable cash amounts during any emergencies that might arise while we have to follow the ACA rules on income limits. We would then begin paying this off when we are 65 as ACA will no longer apply then. (I hope it still applies when we retire in 2 years). If all goes well, we won't use any of this home equity at all.

So… $63K is 3% safe withdrawal of $57K + $6K ret inc until we’re 65, then SS kicks in and we can be more comfortable with say $90K total (47SS + 43 safe withdrawal).

Maybe even one less year? Sorry for the long post.

The stats:

Today 1.83M total, invested in 44/33/19/4 % stocks, intermediate bonds, long bonds, short term cash equiv.

Of the 1.83M about 530K is in "private money inheritance" belonging to DW. We'll be using only dividends from this portion. About 2/3 of the 1.83M is in pretax accounts the rest post tax. However, despite the sizeable post tax amount, we'll be living on mostly taxable withdrawals + taxable dividends with only a few thousand of income that won't count against ACA MAGI numbers. So, it will be a bit tricky to stay under the $63K max 400% fed poverty level for 2 people.

We're both 57 and have 1 teenager in junior college going to school about 3/4 time. This actually presents another challenge as he is not full time and therefore will not be a dependent on our taxes starting this year going forward. (There are reasons why he isn't full time, the good news is he has a part time job and is learning the meaning of saving and paying for his own expenses, car repairs, etc.)

We expect income of $47K/year for both of us from SS at age 65. I'll get a small non-cola pension of $6K/year when we retire at the age of 59 and a couple months.

Firecalc, Fidelity and Vanguard simulations all show 100% chance of success with income of $90K and firing one year earlier in April of 2016. However, to be conservative, we'll hold off until 2017.

We have monitored our expenses for years and they are not low enough yet. We're at $69K/year + taxes + medical ins. We have a ways to go down further to hit $63K including taxes and ins. (Really, $63K is like $51K + $6K taxes, WA has no state inc tax, plan on being there + $6K/year ACA payments).

We have two houses, one here in SoCal, worth about $450K, no mortgage, and our intended retirement house in WA worth about $420K, $200K mortgage.

We're creating a chunk of after tax money that will be used to pay the retirement house mortgage payments + college expense for the DS. This money, about $113K, won’t count against ACA income limits and will be used up when we hit 65.

The DW is worried that, being from So Cal, we’ll be miserable in the winter months in Orcas Island. So… we’ll be traveling back and forth, like snow birds, between the two houses.

I think we can use the Orcas house as a VRBO to make extra money during the summer if we have to as this island appears to be a popular vacation spot.

We are also creating a home equity line of credit that we can draw against until we are 67 years old solely for the purpose of having a way to generate sizable cash amounts during any emergencies that might arise while we have to follow the ACA rules on income limits. We would then begin paying this off when we are 65 as ACA will no longer apply then. (I hope it still applies when we retire in 2 years). If all goes well, we won't use any of this home equity at all.

So… $63K is 3% safe withdrawal of $57K + $6K ret inc until we’re 65, then SS kicks in and we can be more comfortable with say $90K total (47SS + 43 safe withdrawal).

Maybe even one less year? Sorry for the long post.