EvrClrx311

Full time employment: Posting here.

- Joined

- Feb 8, 2012

- Messages

- 648

I think it was one of the series in Zeitgeist (Netflix) that was pointing out the Global Economy, or all of the worlds monetary systems, are based on a necessity for growth through debt. That is, the sustainability of economies requires money to exchange hands, and a lot of that occurs through loans (debt creation) that in turn creates wealth from investment... but fundamentally, wealth must be supported by resources (be it stuff, or labor). Example: If I paid you $1000 to buy seeds and plant apple trees, and charged interest (5%) on the loan, you might pay me back the interest by selling apples... but at some point you may start paying back my loan through other means if your trees don't work out as expected (the debt still exists and requires repayment)... so the debt grows into a chain reaction of obligations that grows and grows, with time, when plans fail... I think the show gets a bit extreme into the conspiracy that the global economy has nowhere to go except total collapse as soon as this debt grows to a level that is unsustainable. I think it was pointing out that debt is essentially a ponzi scheme, because it takes wealth from somewhere and grows it from a source, but it requires a repayment of more than is possible to be created from the debt obligation. So it fabricates new wealth... without resources to support it. I think more likely what is to happen, is that bad debt gets washed out eventually. It'll just be more painful the larger those debts get before they require to be "washed out" as bad. It's unfortunate it's tied into the global economy (example above... if the apple trees didn't work out, then declare bankruptcy and move on... investor needs to be smarter with his $1000 next time).

What was missing from this explanation, in my opinion, is the idea that the advancement of technology creates efficiency that leads to wealth accumulation. However, the assignment of wealth is one I have trouble wrapping my head around entirely. I mean for hundreds of year I guess the global wealth was pretty consistent... and suddenly it has shot up drastically. Populations have also shot up drastically.

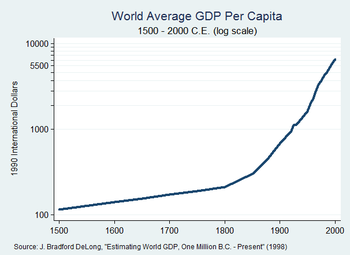

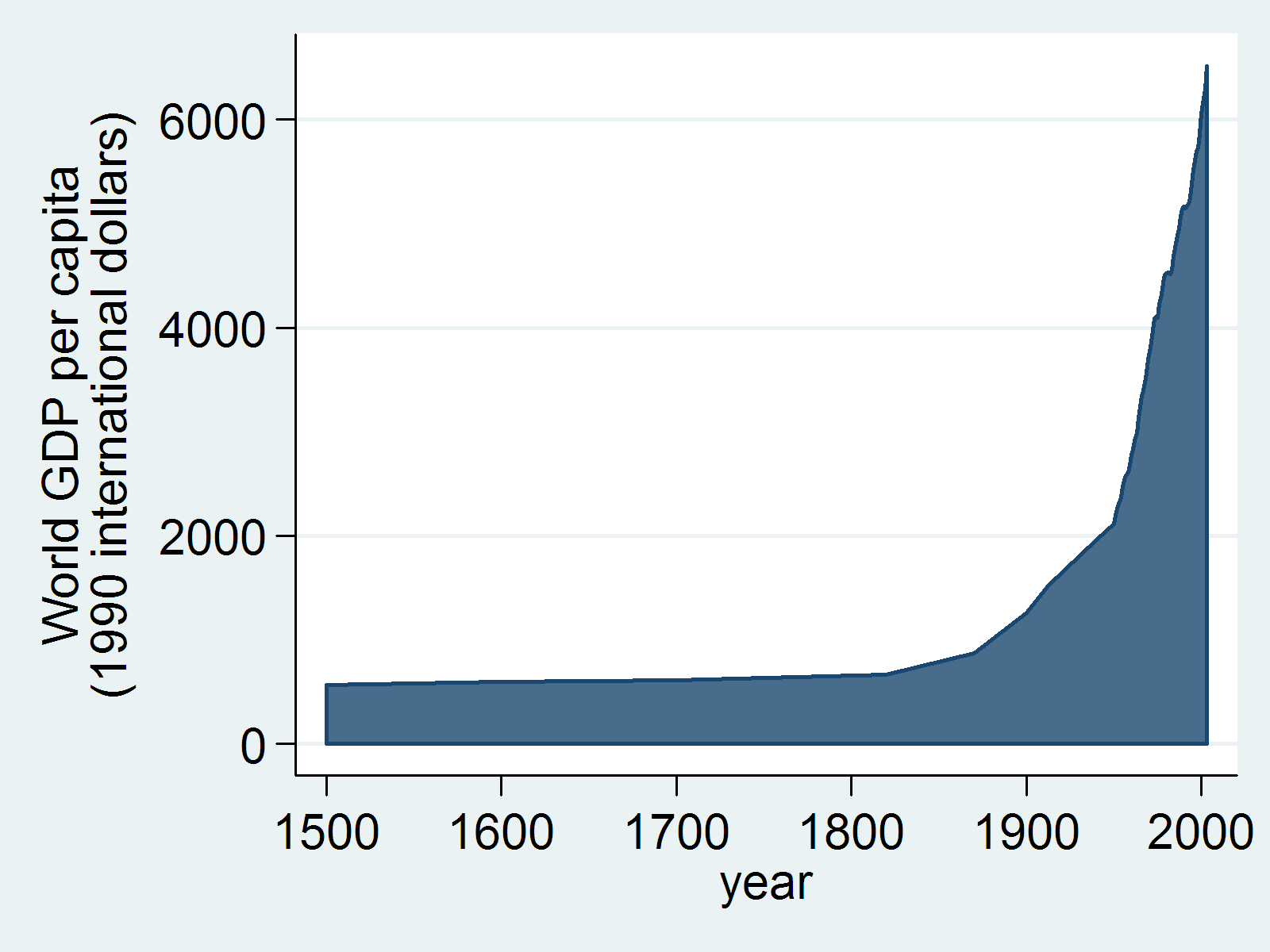

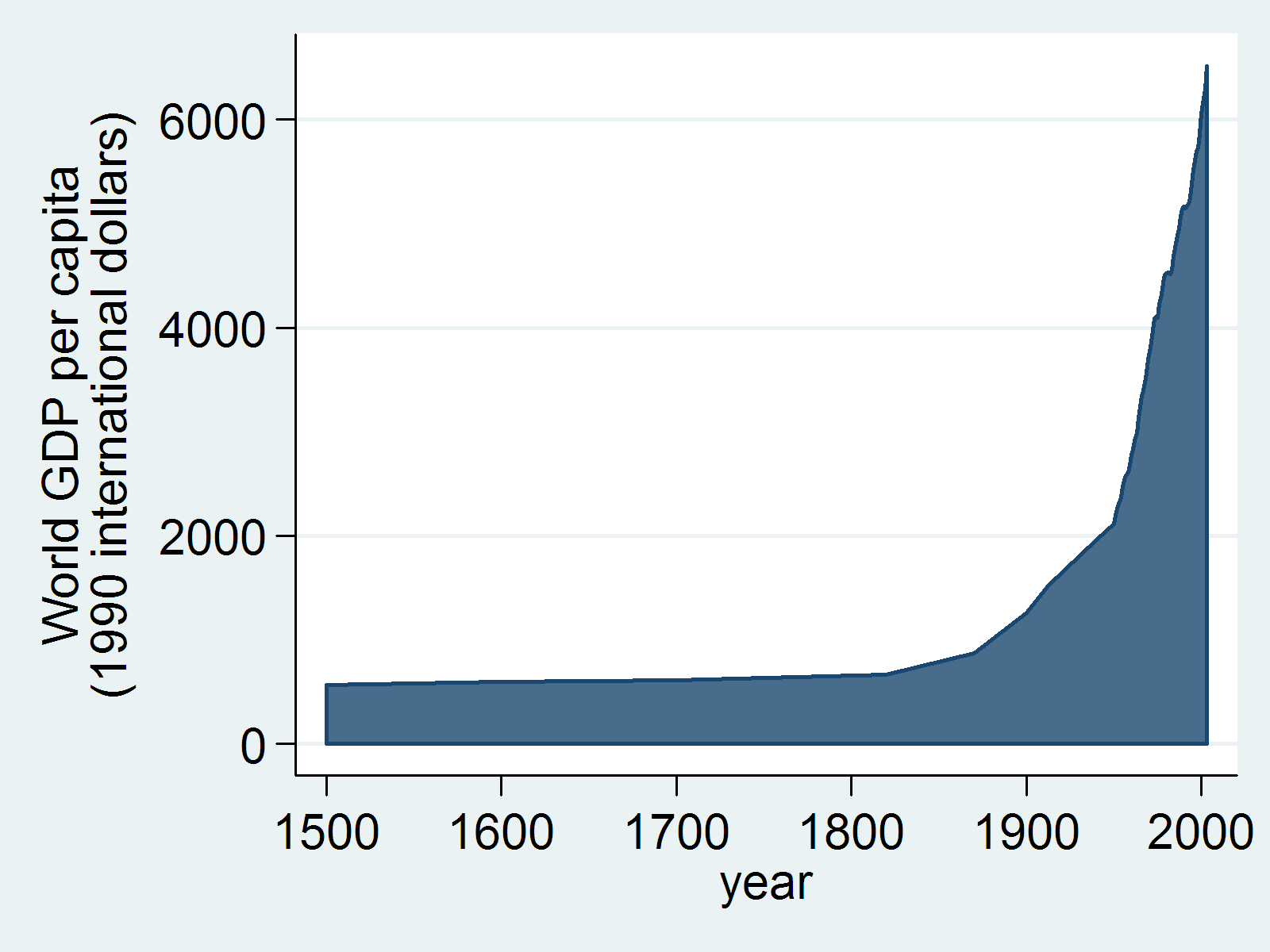

Take the following chart:

Global GDP (the accumulation of all the wealth in the world) is going up... exponentially due to creation of wealth and also population growth. A whole different discussion could take place about who controls that wealth... however that's more politics. There is a number that represents the worlds wealth.

All of the equity markets in the world combine to represent about $70 trillion dollars.

All of the money owned by every human on earth combined is $199 trillion dollars.

The derivatives market (debt on books) is $1,200 trillion dollars.

Interesting fact... the richest 62 people in the world have as much wealth as the bottom 3.5 billion. They all accumulate wealth through debt. That is, they invest it in businesses, people, ideas, solutions, etc... some that work, others that don't, but they expect to grow the wealth through these means.

I'm curious to hear thoughts from the economists here, if there are any, on how debt impacts wealth. On a macro level. Are derivatives sustainable? I'm sure I got much of this wrong

My biggest question, as it related to the future of the worlds wealth is... What would the impact be of a slowing global population... or even a decrease in global population. I assume that would severely, negatively, impact the derivatives market and could cause a lot of debt to go bad... or maybe there is no correlation there?

What was missing from this explanation, in my opinion, is the idea that the advancement of technology creates efficiency that leads to wealth accumulation. However, the assignment of wealth is one I have trouble wrapping my head around entirely. I mean for hundreds of year I guess the global wealth was pretty consistent... and suddenly it has shot up drastically. Populations have also shot up drastically.

Take the following chart:

Global GDP (the accumulation of all the wealth in the world) is going up... exponentially due to creation of wealth and also population growth. A whole different discussion could take place about who controls that wealth... however that's more politics. There is a number that represents the worlds wealth.

All of the equity markets in the world combine to represent about $70 trillion dollars.

All of the money owned by every human on earth combined is $199 trillion dollars.

The derivatives market (debt on books) is $1,200 trillion dollars.

Interesting fact... the richest 62 people in the world have as much wealth as the bottom 3.5 billion. They all accumulate wealth through debt. That is, they invest it in businesses, people, ideas, solutions, etc... some that work, others that don't, but they expect to grow the wealth through these means.

I'm curious to hear thoughts from the economists here, if there are any, on how debt impacts wealth. On a macro level. Are derivatives sustainable? I'm sure I got much of this wrong

My biggest question, as it related to the future of the worlds wealth is... What would the impact be of a slowing global population... or even a decrease in global population. I assume that would severely, negatively, impact the derivatives market and could cause a lot of debt to go bad... or maybe there is no correlation there?