jkern

Full time employment: Posting here.

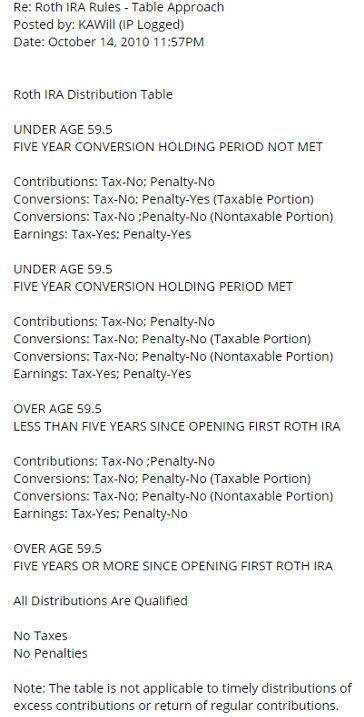

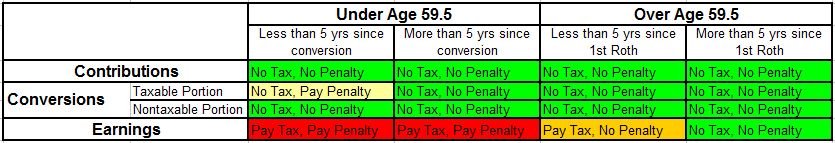

The rules state that in order for Roth earnings to be tax free, they cannot be withdrawn until after 5 years from the opening of the first Roth. How is the first Roth defined? I have a Fidelity Roth that was opened long ago and a Vanguard Roth that was opened only a few years ago. Clearly the Fidelity Roth meets the requirement, what about the Vanguard Roth? Also, what about Roth conversions? If they are converted into a Roth that is 5 years old are they are accessible tax free?