- Joined

- Nov 27, 2014

- Messages

- 9,201

So how do you budget for healthcare? I'm using the Fidelity retirement planner and have a few questions. I'm 56 and DW is 61 so I need to figure out about 9 years for me and 4 years for her for the pre-Medicare expense and then I need to figure out the Medicare run rate. I'm lucky enough to have some employee retiree healthcare benefit, but for sake of budgeting, I am going to ignore that. The company has jerked the retirees around regularly in the past, an I see no reason to rely on them in the future. Anything I get is a bonus.

So I'm thinking about $20-$25K per year for me and DW pre-Medicare. That would be all in (premiums and out of pocket). I think we can stay under the income limits for the current ACA, but similar to the employer issue, the ACA is so unstable it think it best to plan for no subsidy. Any comments on this portion of my logic is appreciated.

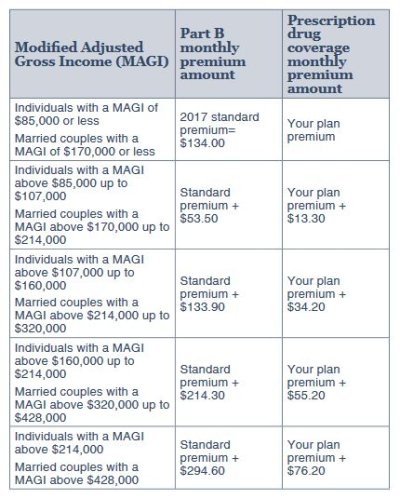

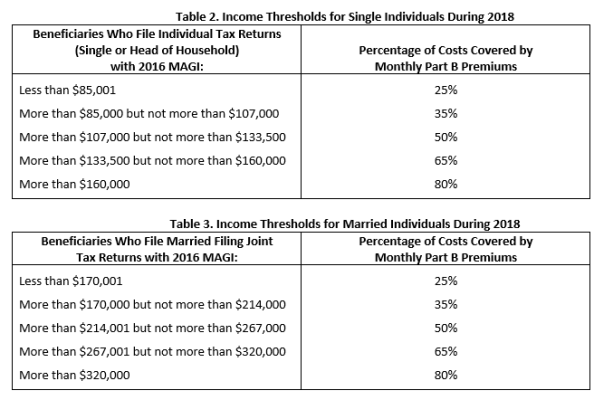

On the Medicare side, how do I find out what my potential expenses are for that time period? I know we'd have to pay deductibles and I understand that I have to pay part B (not sure how much) and I'm pretty sure I'd get some for of supplemental coverage. Generally, this is an area in life where I want to be fully insured. I'll go at risk for a car, but in healthcare, I'm pretty conservative. Where do I go to figure out these costs and make a good estimate in the planner/budget? Should I just shop one of the Medicare advantage plans (using a full coverage plan) to get a good number? Do those pay for everything or does Part B still come out of your SS?

Geez - This planning for retirement is more work than I thought. Maybe I should just say I have enough unless something terrible happens, in which case I'd never have enough. Win or lose. Pass/Fail.

Anyway, thanks for any assistance.

So I'm thinking about $20-$25K per year for me and DW pre-Medicare. That would be all in (premiums and out of pocket). I think we can stay under the income limits for the current ACA, but similar to the employer issue, the ACA is so unstable it think it best to plan for no subsidy. Any comments on this portion of my logic is appreciated.

On the Medicare side, how do I find out what my potential expenses are for that time period? I know we'd have to pay deductibles and I understand that I have to pay part B (not sure how much) and I'm pretty sure I'd get some for of supplemental coverage. Generally, this is an area in life where I want to be fully insured. I'll go at risk for a car, but in healthcare, I'm pretty conservative. Where do I go to figure out these costs and make a good estimate in the planner/budget? Should I just shop one of the Medicare advantage plans (using a full coverage plan) to get a good number? Do those pay for everything or does Part B still come out of your SS?

Geez - This planning for retirement is more work than I thought. Maybe I should just say I have enough unless something terrible happens, in which case I'd never have enough. Win or lose. Pass/Fail.

Anyway, thanks for any assistance.