hopefullyoneday

Recycles dryer sheets

- Joined

- Dec 2, 2017

- Messages

- 247

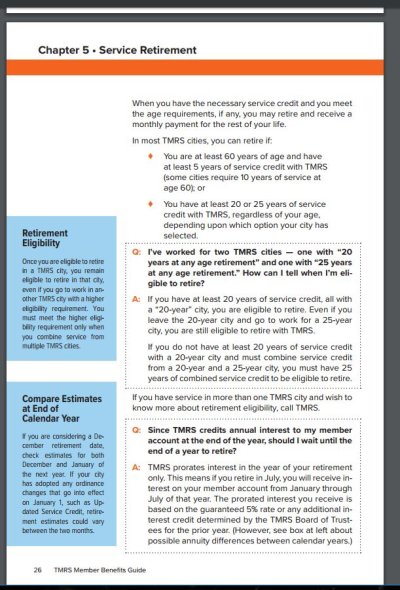

I am a firefighter and the city's pension is in the red and they are considering moving it to TMRS. I want to retire early with 20 years of service and 50 years old and don't know if this will change that for me. Anybody in or had a similar situation or knowledge if this move is good or bad.

Thanks

Greg

Thanks

Greg