Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

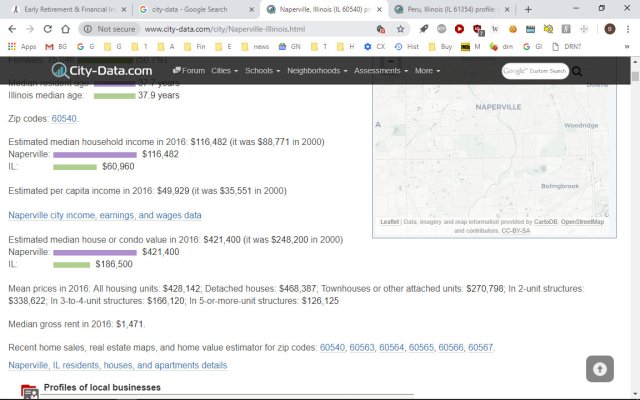

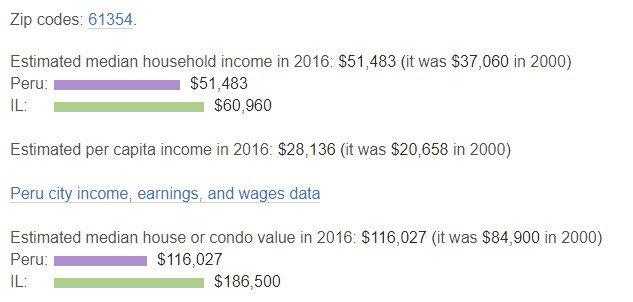

The Federal Reserve has spoken on what should be done to stabilize pensions from the state of Illinois. Tax every home 1% of it’s value in addition to all present taxes for 30 years to fund the pension funds. The median home value state wide is $173,000 so this is a median tax of $1,730 per year on a state with a median income of $60,690 so this would be a 3% tax on average for the pension fund. Astounding the FED (regional I realize) would weigh in on this with an actual proposal so expensive to the average person.

How Should the State of Illinois Pay for its Unfunded Pension Liability? The Case for a Statewide Residential Property Tax | Midwest Economy

https://www.civicfed.org/sites/default/files/can_or_should_a_statewide_property_tax.pdf

How Should the State of Illinois Pay for its Unfunded Pension Liability? The Case for a Statewide Residential Property Tax | Midwest Economy

https://www.civicfed.org/sites/default/files/can_or_should_a_statewide_property_tax.pdf