I agree. They are now talking about 30% unemployment (minimum.......could be higher) within the next couple months. For perspective, the unemployment rate at the height of the depression in 1933 was 25%. There is no way a 30% unemployment rate is baked into the market at this point. And the stimulus/relief package that was passed recently does not begin to deal with an event of this magnitude. This is pretty much an unprecedented event.

A small point of difference, I do think most people do expect unemployment to go to 30%, there is just a faith that because the Central Banks have controlled the markets for 45 years there is no issue they cannot overcome. So therefore there is very limited selling of stocks presently because that would be “timing” the market and that is known as a bad thing. But time will go by, unless there is a sudden a dramatic turn on in the economy, which to me seems very unlikely the following will happen, OVER TIME

1) 401K investments into the market have to slow, as people lose jobs and even people that have jobs cut off 401K contributions to have more cash today.

2) Companies, since they are in a cash crunch will stop borrowing to purchase company stock, as usual company stock purchases tend to happen at highs and issuance at lows, expect stock issuance to raise funds on an overall basis.

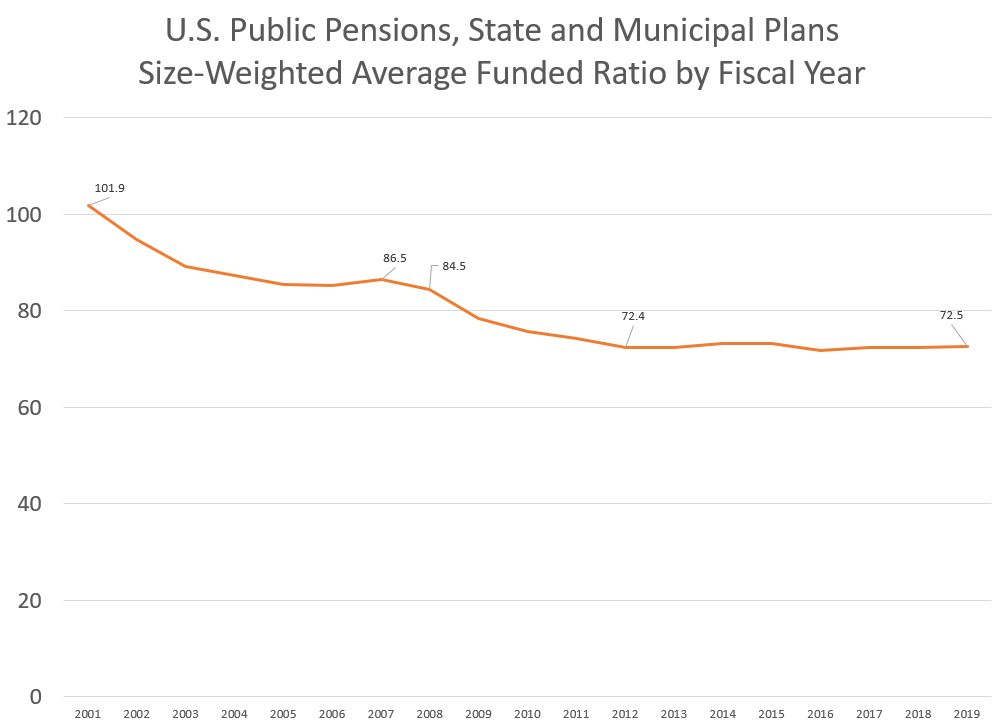

3) States are going to have huge revenue shortfalls and will declare pension funding holidays in order to support the unemployed.

4) Pension funds, with less fundings will have to sell stocks to pay pension participants.

5) The unemployed will have to start withdrawing from 401K especially as time goes forward in order to have funds to live on.

6) The biggest offset to all of this is rebalancing of portfolios of pension and individual investors to their targeted stock allocations. But it is my belief that 1-5 will overwhelm the prices of stocks and lead to continued lows, but this will take time.

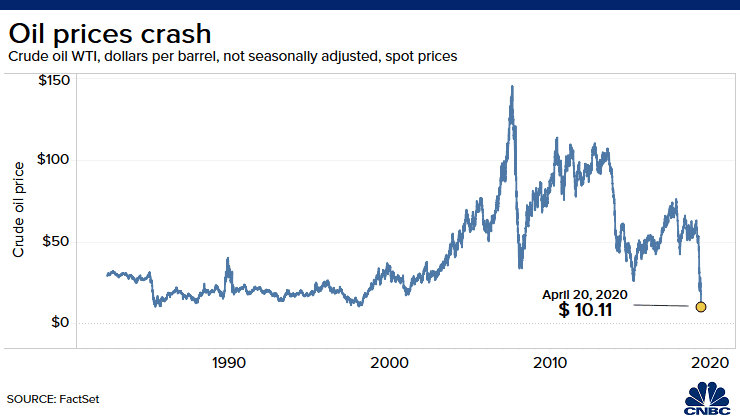

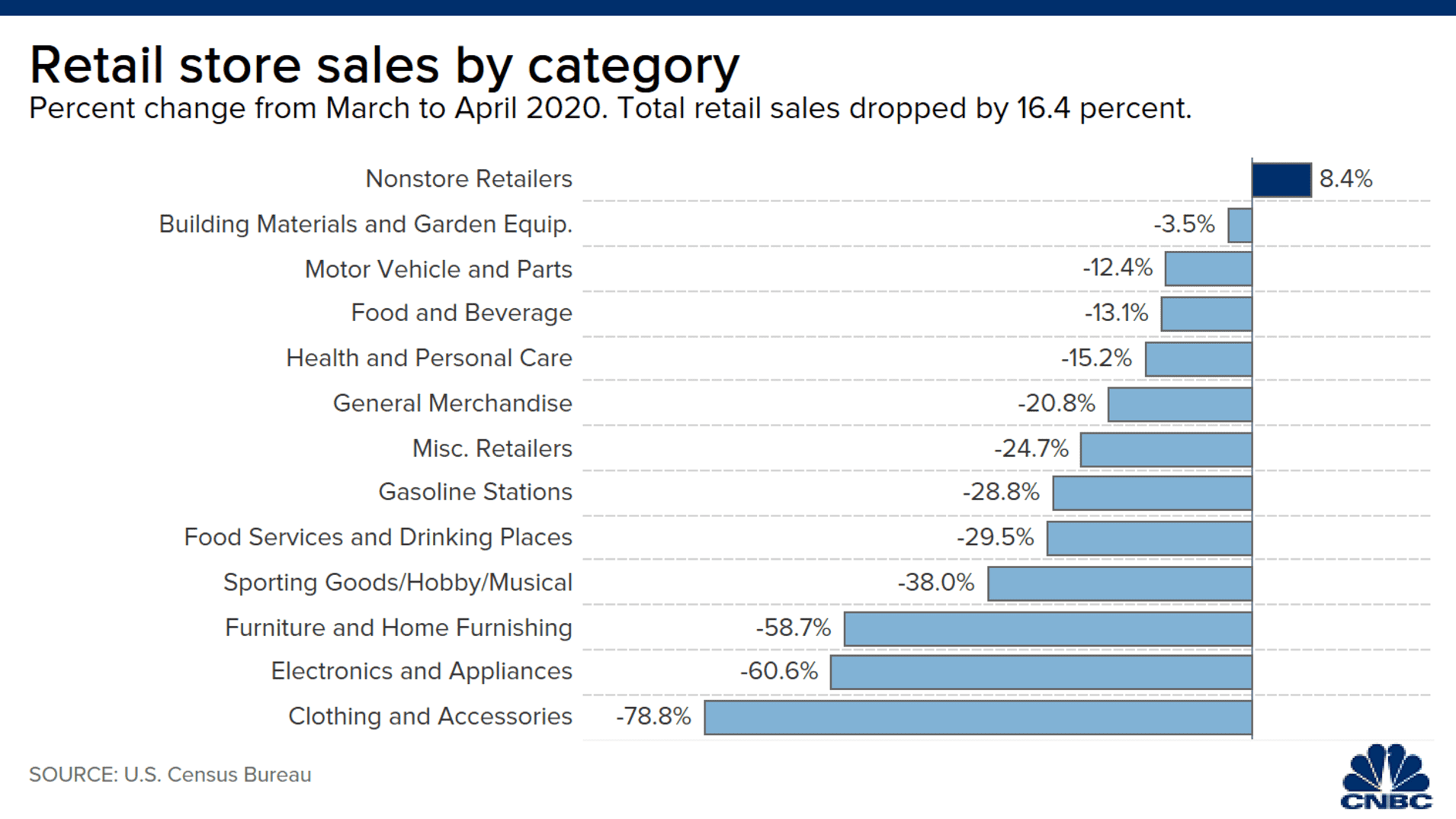

7) Spending is collapsing as people are staying at home further reducing the average revenue even for business that is still functioning, unless you are in the food or nutrition or healthcare market.

8) The belief in the Federal offset in blowing up the budget and the Central Bank balance sheet and will lead to inflation raising prices of stocks and making holding them imperative, is a logical scenario, but by default I think that has to happen down the line after selling is well under way as government choice to economic solution to the corporate and burgeoning Central Bank debt issue.

Unemployment is a very damaging incident and the greatest increase and rate of unemployment in the world is being treated as if this is equivalent to a bunch of Nobel Prize winners blowing up a portfolio at LTCM and having to offset those effects, since the FED accomplished that then of course the complete stoppage of half the industry in the world can be fixed as well and owning companies is the great wealth creator for the future. I am skeptical but watching with vigorous interest and care, I just can’t model a portfolio and stick with a model that never envisioned this type of activity. But in a few years there will be a model that includes this and then there will be Nobel winning papers describing how best to take pandemic portfolio protection.