- Joined

- Oct 13, 2010

- Messages

- 10,786

I agree, it's jumping the gun. But it annoyed me that 20% of my 401k withdrawal is in the hands of the wrong entity. And when "fairness" is involved, logic goes out the window. I'm ready to file an amended return if any of my numbers are wrong (but I think I got 'em all).Since the OP mentioned 1099-B, then they must have had a taxable brokerage account and that will usually mean a 1099-DIV. I cannot imagine that anything on a web site has accurate numbers for ETFs and mutual fund QDI and foreign taxes. I can guess that if one did not have any funds, then the stock dividends would be easy to see and QDI percentage would be the same as last year.

I must say this whole thread gives new meaning to "jumping the gun."

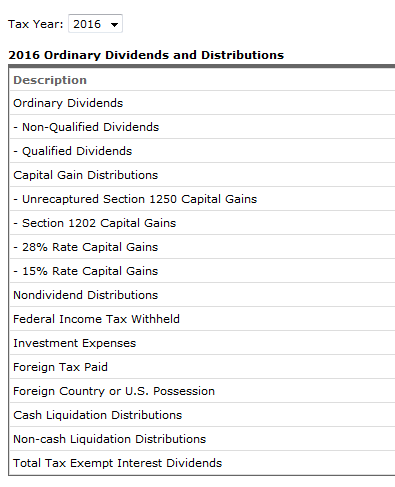

Fidelity has a page you can see what they've got (see below). Is this not to be trusted?

When I filed, I didn't know it wouldn't be of any use until 1/23. I would not have filed if I knew that because, as you say, no ability to change anything now.Wow, I've got to admit to total surprise that folks on this forum are considering filing so early, very little upside and a whole lot of downside.

Lovely. Hopefully we won't have THAT happen this year.The problem that seemed to happen year after year was the IRS system would crash the first day they started accepting returns and sometimes returns would be acknowledged as accepted but in reality were lost in cyberspace. Could be very frustrating trying to explain that to a client that was counting on their money on a certain day and it didn't show up.