Can't comment intelligently on investing, because we never had an appetite for risk.

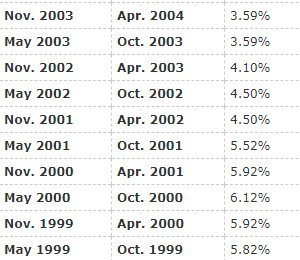

That said, when we retired in the 90's, CD rates were relatively high, and our 5 yr. rates were in the 7% to 8% range. By 2000, we decided to go with 30 yr. IBonds, when each person could open three $10,000 accounts per year. It has worked out okay for us... nothing to brag about, but now, in our 80's as we watch the market rise, we still feel comfortable with our decision. Below, is an excerpt of the rates these bonds are currently paying, based on the year we we bought them. We were earning more, in the earlier years, based on the base rate.

We are members of the "Lucky Few"...

The 'Lucky Few' Reveal the Lifelong Impact of Generation

If I calculated the result correctly, while the inflation rate over the period was about 46%, the actual $ return has been 156%

The percents shown represent the current yield (today) for the years when we were buying the bonds.

I thought it was on topic but I'll yield to your wisdom.

I thought it was on topic but I'll yield to your wisdom.