I read that Yahoo's method is noncompliant with a Financial Accounting Standards Board standard. Anyway, whatever.

So?

And "you read"? That's an impressive citation.

Yahoo! finance is a free web-site. I'm sure they don't want to bother with a formal certification process. You can get their adjusted prices on thousands of trading stocks, and I don't doubt there are some errors from time to time, and they most likely occur on thinly traded stocks.

Despite your never ending deflection/excuse/obfuscation theme, it doesn't matter. We can check a very high profile fund/ETF like VOO, SPY, VTI ourselves against multiple sources if we think there are any errors. We can make a ballpark estimate by just taking the start-end stock price, and add the dividends to the gain. That won't account for reinvesting, but it's simple, and would make any significant error stand out.

And it only takes a bit more effort to take the average length of time the divs were held (half the time period is close enough), and apply the average annualized gain of the fund to those divs and that time, and you'll come within a cat whiskers of doing it a more official way (reinvesting each div).

This is pretty basic arithmetic. Anyone claiming to be an exceptional trader should be able to figure (should already know) this on their own.

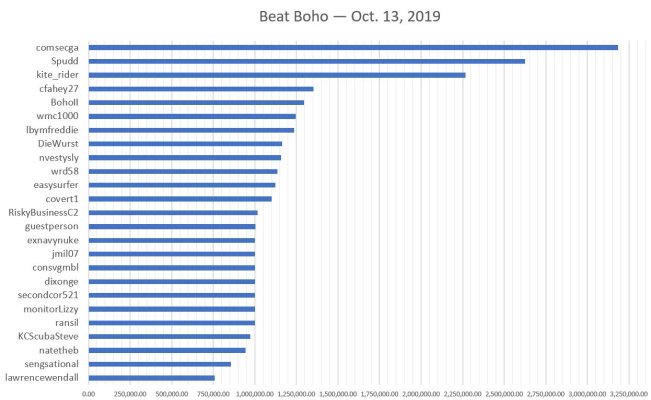

If the contest ends in a photo-finish, we can check those details out, but your trading skills should make that unnecessary, you should blow everyone, and the market away by a huge margin!

-ERD50