Markola

Thinks s/he gets paid by the post

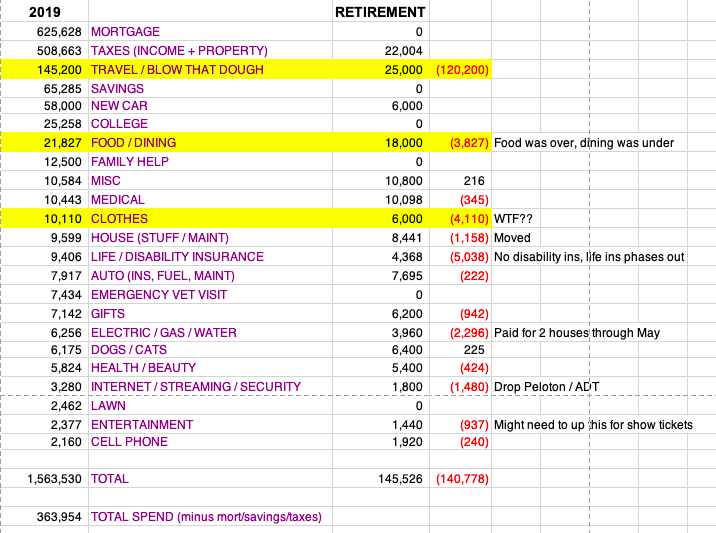

Happy New Year, E-R Forum Community! Our 2019 spending was tracked through You Need A Budget (YNAB) and was in-bounds at $121,000 plus taxes. Our written financial plan is for a semi-retirement for about 7 years before full FIRE. DW is already in semi-retirement and I will be too by 2021. We use Vanguard/Flagship Professional Advisor Services, and their software says our plan is “98% On Track,” which makes me very happy. Replicating our Vanguard plan in Personal Capital Retirement Planner also gives a high success rate. They both take into account separately all the big components: Our general spending, travel, mortgage and health care spending projections, some house renovation we want to do this year and a new car in 2023. I know this is more of a DIY crowd but this system is working well for us as a couple. Now I just have to make it through 2020 on the final year of this job, which will involve some challenging psychology pretending to care gravely about stuff in meetings I’m already just not caring about as much anymore. Cheers!

Last edited: