I use Fidelity Full View, which automatically accumulates and categorizes all of our spending transactions. Only effort by me is to scroll through, validate everything, and correct a category occasionally, which I usually do every 3-4 days.

Spending was pretty high in 2019 for DW and myself at $128K. But in our 6th full year of ER, we're finally closing in on the FIRECalc 95% figure. The first few years were quite conservative by comparison at about 25-30% below.

But it was a strange year, spending-wise. No travel at all. Usually travel is the bulk of our discretionary spend. Instead, we bought a 2019 Subaru Forester... our first new car since 2001. We added a bike rack, a rooftop cargo carrier, and went camping at many of our favorite Texas State Parks. I think we hit 6 of them this year, with lots of biking, hiking, and swimming.

Also, we finally took care of a major plumbing repair that we've been deferring forever. We replaced all the slow-leaking, 50-year-old cast iron drain pipes inside the house with PVC. There are two upstairs baths, so lots of plumbing between the two floors. I did some of the demo myself and hired out the rest of the plumbing. We also hired out the rather extensive drywall repair that followed. But I did all the finish trim work, painting, and some minor electrical.

We also finally finished our master bath remodel, which we had stopped about half way in once we realized the severity of the problem with the old cast iron pipes.

Finally, this is also our first year with LARGE Roth conversions, which will drive roughly $20K additional federal tax, although that expense will happen in 2020 so it's not included in the $128K.

For 2020, we've already got some international travel booked and we plan to do even more camping/biking/hiking, which is not expensive at all. We'll take a break from major home renovations except for some minor stuff I have planned for the kitchen and maybe some new lighting fixtures. Also have a new 15" planer picked out for the woodworking shop. Even with higher Roth tax, we should be in the $120-125K range in 2020.

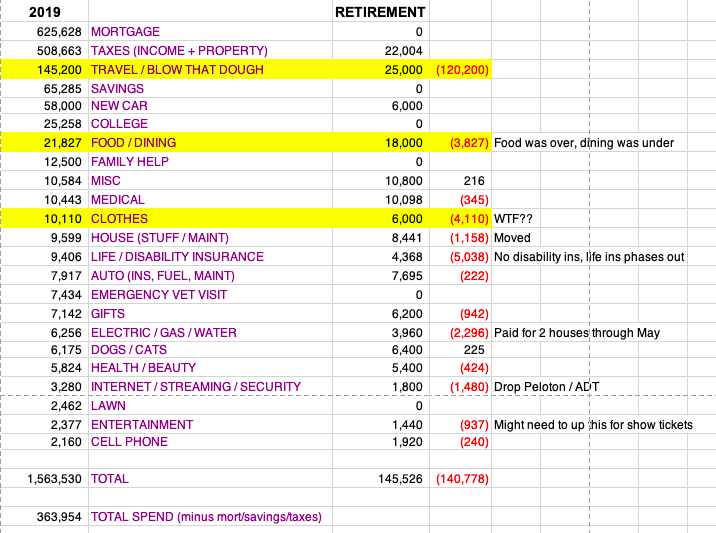

Here's the 2019 tally:

Category

|$K|

New car|

28

|2019 Subaru Forester

Plumbing|

9

|replace all cast iron drain pipes

Drywall|

5

|repair drywall after plumbing demo

Master Bath|

5

|finish master bath remodel

One-shots|

47

|subtotal

Prop tax|

11

|main house only, excludes rental

Fed tax|

6

|small Roth conversions

Health ins|

6

|medical and vision, no dental ins

Other ins|

4

|auto, home, umbrella, excludes rental

Med OoP|

6

|deductibles, copays, co-ins, dental, prescript, vision

Utilities|

5

|electric, water, waste, nat gas

Tech|

3

|cell phones, internet, streaming, security, cloud

Groceries|

8

|includes wine and some household supplies

Entertainment|

6

|sporting events, concerts, movies, eating out

Transport|

5

|gasoline, car service, tolls, registration, Uber

Other|

21

|clothes, Amazon, household, pool, gifts, misc

Ongoing|

81

|subtotal

Total|

128