Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

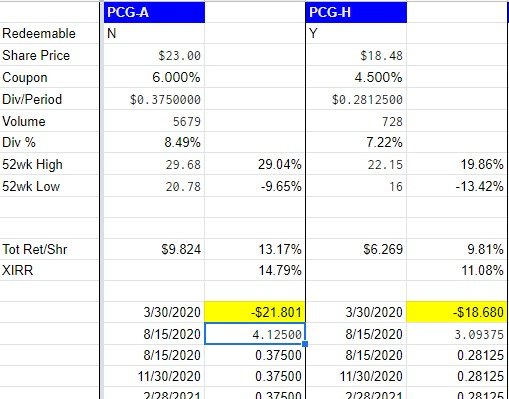

Incidentally Copyright's answer is pretty much the amount of thought that has gone into this latest economic experiment, pretty much drops the entire economy of the United States to a blog post on a preferred stock forum. But since this is so imprecise that is why I am so worried about preferred stock pricing. They get destroyed in two ways off that formula - exploding money supply driving up interest rates or contracting velocity. I will wait this out until I can see a better resolution and Copyright's layout is as precise as anyone at the FED knows at the present time