Ok – I’ll bite. Not because of any oracle forecasting ability, but because thinking about and expressing my opinion with basis provided helps solicits feedback on information that may be misinterpreted or unknown on my part. For example, I had not even deeply thought about my own risk tolerance until reading this forum (before retiring); how it changes over life and the different strategies. We don’t gain anything from a snarky two line retort. The well expressed differing perspective is priceless.

Reentry point is controversial because we all have different perspectives depending on risk tolerance (age / necessary with drawl rate from portfolio / personal preference and beliefs). DW and I just retired, and previously had implemented a rising equity glide path portfolio to navigate Sequence of Returns Risk by minimizing both downside and upside potential. And wouldn’t you know it – a black Covid-19 swan six months after retirement. Lucky Duck. My reentry point is not required and if implemented does not have a clear metric – Bankruptcies. (I can stand pat and just be fine – but this event, however dreadful, can be an opportunity.)

IMHO the big USA indices are too expensive now based on current PE values and about to get worse this week. The ‘big three’ stock indices are Dow Jones Industrials, NASDAQ and S&P500. Today, only down about 13% from their February 2020 high. However, the underlying Price/Earnings ratios have increased about 20% in the past few weeks even though stock prices are down overall. Major USA stock indices are more expensive relative to earnings now than even at their all time high in February! This week, about 1/3 of the earnings reports will be issued in USA for the first quarter – analysts have been flying blind using last available numbers since the majors pulled their annual earnings forecasts. This week’s earning report is very likely to drive PE up even higher. There was roughly $30 trillion in market capitalization for the USA in January. Take off 15% so far and it approximates the trillions of dollars being injected (inefficiently) into the economy by the Treasury and the Fed. Helicopter money combined with the demand collapse, a 20% increase for M2 supply and a productivity hit mostly explains why inflation is not an issue. Because the needed liquidity injection is not perfect – bankruptcies will occur later.

The supporting effect on the big 3 stock price indexes via automatic buying will vary going forward. Major companies are stopping stock buybacks, states/municipalities conserve cash by stopping/cutting pension fund contributions, and individual 401ks will start to fade with furloughs and cutback on company match funds, the ballast effect of rebalancing pension and life cycle funds will continue, the buy on the dip folks have less capital now to buy on the next dip, Treasury and Fed continue focus on the companies with stock in the big three USA indexes. The publicly traded Foreign, Mid-size and Small size stocks don’t get as much of these supporting functions outlined above. By comparison, these three indices are down roughly 20%, 25%, and 30% respectively – compared to the 13% down for the big boys having the automatic backstops. Still, the big boys have taken on a lot of debt that has to be paid back eventually or else face bankruptcy – this alone will weigh down earnings for years even if the loan interest rate is low.

Once the states reopen - Business bankruptcies will be predicated on consumer behaviors and will lead the way to the bottom. Bankruptcies are starting to show up with large department store chains and smaller energy producers. Small businesses are stressed to the max with failure of the PPP and had thin margins to begin with. Airlines and Cruise ship operators are swimming in a sea of red ink and although they have been supported by the Fed and Treasury – some are going to fail because their business models are built on selling every seat and room on every flight and cruise all the time. Similar business model for the hotel and restaurant chains to operate at around 70-80% capacity will cull the weak. Oil producers are already in the hurt locker. The vendors / suppliers for these industries will suffer. Before corporations wipe out shareholders in a bankruptcy filing, they do everything possible to soak up the last bit of credit – then negotiate for better loan terms. The bankruptcy process is not transparent to the markets and bankruptcies take months to pulse through the individual state legal and corporate systems – finally landing on the balance sheets of bond holders and financial institutions if a restructured business cannot reopen. (Cue music for the Fed to enter and save the banks again.) Personal bankruptcies are even less transparent – but impact credit markets in our consumer driven society. How long did it take for the ‘rational markets’ to reach bottom last financial crisis once the bankruptcies were building? June 2007 (Bear Stearns and Countrywide say ‘uh, we have problems’) to March 2009 (Green Shoots) – around a 45% discount in the S&P 500 index.

How many bankruptcies really depend on the following impact on consumer behavior:

- Will a vaccine make a difference in consumer behavior? Probably yes. However, it is likely to not be widely available for at least a year. In the meantime – the scars of bankruptcies and unemployment grow each day.

- Will herd immunity save consumer behavior? Potentially yes. However, there are some discouraging reports about reinfection that make me question the tail event like an HIV infection. In the meantime – the scars of bankruptcies and unemployment grow each day.

- Will a therapy be developed to lessen the effects of the virus? That may only be weeks away in announcement, but much longer time for scale up. A therapy treatment may be our best near term hope for the economy.

The International Monetary Fund (I am not a fan) posted four scenarios in their April report. States a lot of the obvious and that this economic downturn is worse than the 2008 financial crisis.

https://www.imf.org/en/Publications/...weo-april-2020

There are a couple of ballpark scenarios for USA/world recovery in the report.

1) Baseline (Likely what the stock market prices are currently based on) - everyone plays nice together (but apart) and coherent public health policies around the globe result in the virus going away in the 2nd half 2020, but with USA GDP down about 6 points overall for the year. Strong recovery in 2021 - not yet matching 2019 GDP.

2) Outbreak continues into 2nd half of 2020. Subtract 2-3 additional points growth GDP from baseline. More permanent 'scarring' (bankruptcies) destroys capital.

3) Outbreak recurs in 2021. Subtract about 4 - 5 more points growth because there are even more bankruptcies.

4) Outbreak continues in 2nd half of 2020 AND recurs in 2021. Subtract 7-8 points growth from baseline.

(Of course, there could always be some other shock coming on top of what we are dealing with now. Like an unstable North Korea or Iran.)

For the baseline, there is some hand waving about supervisors telling banks to give debtors and mortgage holders a holiday by just sucking it up, and that emerging nations are less affected because their economies are not service oriented like the G7. I disagree with the likelihood of the first, but see the logic of the second premise. Some emerging countries are also not well capitalized and carry smaller loans; caveat being that the loans are usually based in dollars.

Final thoughts

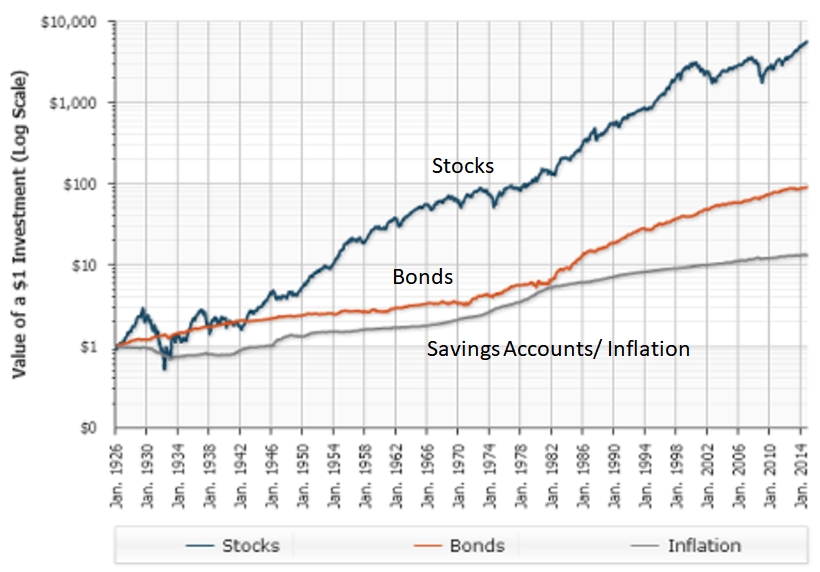

If you are young worker with solid employment saving for more than 10 years out – stay the course and continue buying index funds on a regular basis to Dollar Cost Average in.

Older retiree? – consider stay the course on the AA that let you sleep at night before the crisis and keep a sensible portfolio with drawl.

For the near and new retirees things are complicated. Do you stay the course or wager a little bit of the portfolio because you are down for the YTD? I would be just fine to stick to a rising equity portfolio – but I will probably DCA in at some point and accelerate to a 65/35 split once bankruptcy announcements and layoffs slow down. I think we will at least see a second wave of infections and that scenario is not yet baked into the big three markets. Just look at what is happening now in Singapore, and even China.

But what the hell do I know.