Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What am I missing (first world problems)?

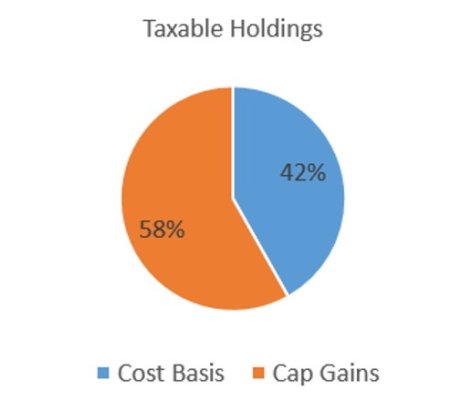

Like some/but not all here I presume, we are sitting on a relatively large chunk of capital gains in our taxable account. We haven't needed to sell anything, and we don't have any holdings with a loss, so I can't sell and use an offsetting loss. Since we pay taxes on dividends annually, they've been deposited in our checking account for many years, so all our gains are 99%+ long term appreciation (no dividend reinvestment).

I am going to continue with very large Roth conversions for the next 6 years or so, so I certainly don't want to take cap gains now. All our AGI comes from dividends, interest & conversions. We use cash to supplement dividends & interest for spending withdrawals.

There's no way to know what future cap gains tax brackets will be, presumably less favorable than today, but I plan to start withdrawing from taxable when Roth conversions are done, TIRA RMD's will be low and we'll have more than enough income from Soc Sec, dividends (taxable) and TIRA RMD's. At that point I'll be able to control exactly what we take in cap gains each year. I don't foresee a time we'll be forced to sell and take an outsized cap gains hit.

Like some/but not all here I presume, we are sitting on a relatively large chunk of capital gains in our taxable account. We haven't needed to sell anything, and we don't have any holdings with a loss, so I can't sell and use an offsetting loss. Since we pay taxes on dividends annually, they've been deposited in our checking account for many years, so all our gains are 99%+ long term appreciation (no dividend reinvestment).

I am going to continue with very large Roth conversions for the next 6 years or so, so I certainly don't want to take cap gains now. All our AGI comes from dividends, interest & conversions. We use cash to supplement dividends & interest for spending withdrawals.

There's no way to know what future cap gains tax brackets will be, presumably less favorable than today, but I plan to start withdrawing from taxable when Roth conversions are done, TIRA RMD's will be low and we'll have more than enough income from Soc Sec, dividends (taxable) and TIRA RMD's. At that point I'll be able to control exactly what we take in cap gains each year. I don't foresee a time we'll be forced to sell and take an outsized cap gains hit.

Attachments

Last edited: