Out of Steam

Thinks s/he gets paid by the post

- Joined

- Mar 14, 2017

- Messages

- 1,669

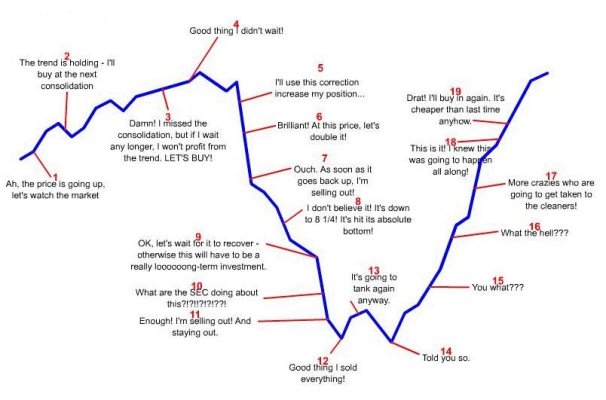

We definitely found out last March that our risk tolerance was less than we thought it was, but were able to wait long enough to recover much of the initial decline.It seems to me that you took a loss though, by selling last May. Your AA should reflect your risk tolerance and temperament.

I'm not inclined to second-guess that decision, or to push too much money back in in the hope of making up for it. Long-term goal will be an allocation of roughly 40%, mainly by reinvesting proceeds from an ESOP in stocks in the next five years.